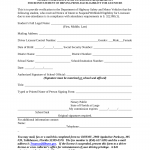

Form HSMV 72871. Student Notification for Home Education Program - Florida

The Form HSMV 72871, known as the Student Notification for Home Education Program, is used in Florida to notify the Department of Highway Safety and Motor Vehicles about a student's enrollment in a home education program.

Form HSMV 72870. Student Notification for Driving Eligibility for Licensure - Florida

The Form HSMV 72870, referred to as the Student Notification for Driving Eligibility for Licensure, is used in Florida to notify students about their eligibility for obtaining a driver's license.

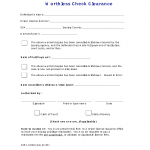

Form HSMV 72862. Worthless Check Clearance - Florida

The Form HSMV 72862, known as the Worthless Check Clearance form, is used in Florida to resolve outstanding issues related to bounced or worthless checks issued for payment of motor vehicle-related fees.

Form HSMV 72836. NotificaciГіn a Estudiante para Programa de EducaciГіn en el Hogar - Florida

The Form HSMV 72836, known as NotificaciГіn a Estudiante para Programa de EducaciГіn en el Hogar, is used in Florida within the context of homeschooling.

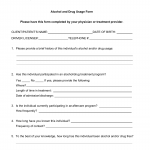

Form HSMV 72480. Alcohol and Drug Usage Form - Florida

The Form HSMV 72480, referred to as the Alcohol and Drug Usage Form, is used in Florida to gather information regarding an individual's alcohol or drug usage history.

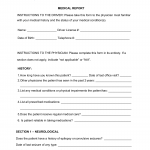

Form HSMV 72423. Medical Report - Florida

The Form HSMV 72423, known as the Medical Report, is used in Florida to report an individual's medical condition or impairment that may affect their ability to safely operate a motor vehicle.

Form HSMV 72201. FRTP Rules of Professional Conduct - Florida

The Form HSMV 72201, known as the FRTP Rules of Professional Conduct, is utilized in Florida within the context of the Financial Responsibility Traffic School (FRTP).

Form HSMV 72190. Report a Driver Whose Ability is Questionable - Florida

The Form HSMV 72190, referred to as the Report a Driver Whose Ability is Questionable, is used in Florida to report concerns about an individual's ability to safely operate a motor vehicle.

Form HSMV 72120. Application for Developmental Disability Designation - Florida

The Form HSMV 72120, also known as the Application for Developmental Disability Designation, is used in Florida to request a designation for individuals with developmental disabilities.

Form HSMV 72119. Mature Driver Vision Test - Florida

The Form HSMV 72119, known as the Mature Driver Vision Test, is a document issued by the Florida Department of Highway Safety and Motor Vehicles. This form is used to assess the visual acuity of mature drivers (typically aged 80 and above) during the driver's license renewal process.