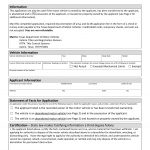

Form VTR-71-2. Application for Authority to Dispose of a Motor Vehicle to a Demolisher - Texas

The Form VTR-71-2 is used in Texas to apply for authority to dispose of a motor vehicle to a demolisher. This form is necessary when individuals or entities want to dispose of a motor vehicle that is no longer in operable condition and needs to be dismantled or crushed.

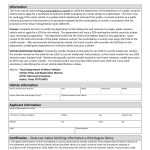

Form VTR-71-4. Application for Certificate of Authority to Dispose of an Abated Public Nuisance Vehicle - Texas

The Form VTR-71-4 is used in Texas to apply for a certificate of authority to dispose of an abated public nuisance vehicle. This form is necessary when individuals or entities need to dispose of a motor vehicle that has been declared a public nuisance and has undergone the abatement process.

Form VTR-71-6. Application for Authority to Dispose of an Abandoned Nuisance Vehicle to a Demolisher - Texas

The Form VTR-71-6 is used in Texas to apply for authority to dispose of an abandoned nuisance vehicle to a demolisher. This form is necessary when individuals or entities want to dispose of an abandoned motor vehicle that is considered a nuisance and needs to be dismantled or crushed.

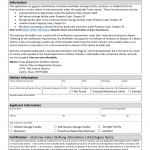

Form VTR-76. Application for Disaster Relief Vehicle License Plates - Texas

The Form VTR-76 is used in Texas to apply for disaster relief vehicle license plates. This form is necessary when individuals or entities want to obtain special license plates for vehicles used in disaster response and relief efforts.

Form VTR-77. Application for Water Well Drilling or Construction Machinery License Plate - Texas

The Form VTR-77 is used in Texas to apply for a license plate for water well drilling or construction machinery.

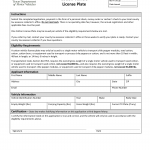

Form VTR-810. Application for Texas Agricultural License Plates - Texas

The Form VTR-810 is used in Texas to apply for Texas agricultural license plates. This form is necessary when individuals or entities want to obtain specialized license plates for vehicles primarily used for agricultural purposes.

Form VTR-815. Application for Cotton Vehicle License Plate - Texas

The Form VTR-815 is an application form used in the state of Texas to apply for a Cotton Vehicle License Plate.

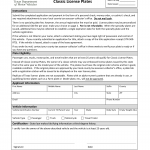

Form VTR-850. Application for Classic License Plates - Texas

The Form VTR-850 is an application form used in Texas to apply for Classic License Plates. This form is designed for individuals who own and wish to register vehicles that meet the criteria for classic or antique status, typically defined by the age and historical significance of the vehicle.

Form VTR-900. Application for Auction License Plate Transfer - Texas

The Form VTR-900 is an application form used in Texas to facilitate the transfer of auction license plates between dealerships. This form allows licensed motor vehicle dealers to transfer auction license plates issued to them to another dealership within the state.

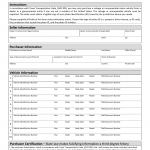

Form VTR-901. Purchaser's Certification of Export-Only Sale - Texas

The Form VTR-901 is a certification form used in Texas for export-only sales of motor vehicles. This form serves as a declaration by the purchaser that the vehicle being sold will be exported out of the United States and will not be registered or operated on public roads within the state.