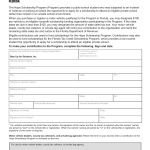

Form DR-HS1. Hope Scholarship Program Contribution Election Florida Department of Revenue form - Florida

The Form DR-HS1, also known as the Hope Scholarship Program Contribution Election form, is a document issued by the Florida Department of Revenue.

Form VTR-55. Application for Package Delivery License Plate - Texas

The Form VTR-55 is used in Texas to apply for a package delivery license plate. This form is necessary when individuals or companies want to obtain specialized license plates for vehicles primarily used for package delivery services.

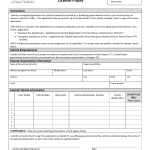

Form VTR-626. Application for Seasonal Agricultural Registration - Texas

The Form VTR-626 is used in Texas to apply for seasonal agricultural registration. This form is necessary when individuals or businesses engage in seasonal agricultural activities and need to register their vehicles for limited periods.

Form VTR-62-A. Application for Standard Texas Exempt License Plates - Texas

The Form VTR-62-A is used in Texas to apply for standard exempt license plates. This form is necessary when eligible entities, such as government agencies or nonprofit organizations, want to obtain license plates that indicate their exemption from certain registration fees.

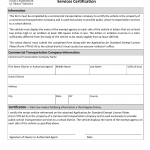

Form VTR-62-BUS. Public School Transportation Services Certification - Texas

The Form VTR-62-BUS is used in Texas to apply for public school transportation services certification. This form is necessary when individuals or entities provide transportation services for public schools and need to certify their eligibility.

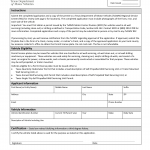

Form VTR-62-EMS. Application for Exempt Registration for an Emergency Medical Services Vehicle - Texas

The Form VTR-62-EMS is used in Texas to apply for exempt registration for an emergency medical services (EMS) vehicle. This form is necessary when EMS providers want to register their vehicles for exemptions related to certain registration fees and requirements.

Form VTR-62-F. Application for Exempt Registration of Certain Rescue Vehicles - Texas

The Form VTR-62-F is used in Texas to apply for exempt registration of certain rescue vehicles. This form is necessary when individuals or entities want to register their vehicles used exclusively for rescue purposes and seek exemptions from certain registration requirements.

Form VTR-64. ASE Safety Inspection for Assembled Vehicles - Texas

The Form VTR-64 is used in Texas for the ASE (Automotive Service Excellence) safety inspection of assembled vehicles. This form is necessary when individuals or entities have assembled a vehicle from various parts and need to obtain a safety inspection certificate.

Form VTR-65. Application for Honorary Consul License Plates - Texas

The Form VTR-65 is used in Texas to apply for honorary consul license plates. This form is necessary when individuals serving as honorary consuls want to obtain special license plates indicating their diplomatic status.

Form VTR-67. Application for Permit License Plates - Texas

The Form VTR-67 is used in Texas to apply for permit license plates. This form is necessary when individuals or entities need temporary license plates for specific purposes, such as transporting unregistered vehicles or conducting vehicle tests.