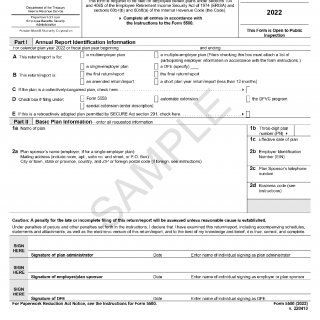

Form 5500. Annual Return/Report of Employee Benefit Plan

Form 5500, also known as the Annual Return/Report of Employee Benefit Plan, is a form that is used to report information about employee benefit plans to the Department of Labor, the IRS, and the Pension Benefit Guaranty Corporation. The main purpose of this form is to ensure that employee benefit plans are operated in compliance with the law and that plan participants receive the benefits they are entitled to.

The form consists of several parts, including general plan information, financial information, and participant information. There are also additional sections for certain other information, such as information about plan investments and contributions.

When completing Form 5500, it is important to consider the specific details of the employee benefit plan, such as the plan type, the plan sponsor, and the plan administrator. This information will be used to report the plan's financial and participant information accurately.

In addition to the form itself, you may need to attach additional documents such as financial statements or schedules of plan assets. It is important to keep accurate records and maintain these documents for future reference.

Some examples of when Form 5500 might be required include when a plan has more than 100 participants, when a plan is terminated, or when a plan is subject to an audit.

Strengths of Form 5500 include its ability to ensure that employee benefit plans are operated in compliance with the law and that plan participants receive the benefits they are entitled to. Weaknesses may include the complexity of the form and the need for accurate record-keeping.

Alternative forms or analogues to Form 5500 may include state-specific employee benefit plan forms or other federal tax forms such as Form 1099-R for distributions from retirement plans. The main difference between these forms is the specific information being reported and the reporting requirements.

To fill and submit Form 5500, you can either do so electronically through the Department of Labor's EFAST2 system or by mailing a paper form to the appropriate address. Once submitted, the form will be stored electronically by the Department of Labor for future reference and auditing purposes.