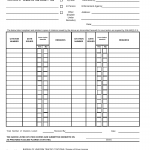

Form HSMV 75954. Florida Uniform Traffic Citation Transmittal Form - Florida

The Form HSMV 75954, known as the Florida Uniform Traffic Citation Transmittal Form, is used in Florida to transmit traffic citations from law enforcement agencies to the appropriate courts or other entities involved in processing the citations.

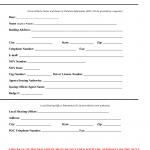

Form HSMV 75710. Red Light Camera - Florida

The Form HSMV 75710, known as the Red Light Camera form, is used in Florida to dispute a citation issued as a result of a violation captured by a red light camera. Its purpose is to provide a mechanism for drivers to contest the citation and present their case.

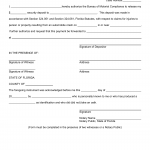

Form HSMV 74039. Authorization to Pay Security - Florida

The Form HSMV 74039, referred to as the Authorization to Pay Security form, is used in Florida to authorize a financial institution to pay security funds to the DHSMV on behalf of an individual or business entity.

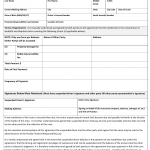

Form HSMV 74036. Agreement for Release and Monthly Repayment Note - Florida

The Form HSMV 74036, known as the Agreement for Release and Monthly Repayment Note, is used in Florida to establish an agreement between a debtor and the Florida Department of Highway Safety and Motor Vehicles (DHSMV) for the release of a driver license that was suspended due to a financial oblig

Form HSMV 74034. Judgment Consent Form - Florida

The Form HSMV 74034, known as the Judgment Consent form, is used in Florida to voluntarily consent to a judgment regarding a motor vehicle-related matter. Its purpose is to formalize an agreement between parties involved in a dispute or legal proceeding.

Form HSMV 74010. Court Authority to Reinstate (Failure to meet financial obligations suspension) - Florida

The Form HSMV 74010, referred to as the Court Authority to Reinstate form, is used in Florida to reinstate driving privileges that were suspended due to a failure to meet financial obligations, such as failing to pay fines or fees related to traffic violations.

Form HSMV 74007. Security Deposit Refund Request - Florida

The Form HSMV 74007, known as the Security Deposit Refund Request form, is used in Florida to request a refund of a security deposit that was submitted for certain motor vehicle-related transactions. Its purpose is to initiate the process of returning the security deposit to the applicant.

Form HSMV 73644. Driver License Refund Request - Florida

The Form HSMV 73644, known as the Driver License Refund Request form, is used in Florida to request a refund for driver license-related fees. Its purpose is to initiate the process of obtaining a refund for payments made for driver license services.

Form HSMV 73209. Criminal Justice Information Request form - Florida

The Form HSMV 73209, referred to as the Criminal Justice Information Request form, is used in Florida to request access to criminal justice information for official purposes. Its purpose is to facilitate the lawful collection of information related to criminal records and history.

Form HSMV 72997. Medical Advisory Board Recommendation Form - Florida

The Form HSMV 72997, known as the Medical Advisory Board Recommendation form, is used in Florida to seek a recommendation from the Medical Advisory Board regarding an individual's medical fitness to operate a motor vehicle.