Form HSMV 83145. Personalized License Plate Fee Schedule - Florida

Form HSMV 83145 is a fee schedule provided by the Florida Department of Highway Safety and Motor Vehicles (HSMV) specifically for personalized license plates. This form outlines the fees associated with requesting and obtaining personalized license plates in Florida.

Form HSMV 83140. License Plate Rate Chart - Florida

Form HSMV 83140 is a license plate rate chart provided by the Florida Department of Highway Safety and Motor Vehicles (HSMV). This chart serves as a reference document that displays the rates and fees associated with different types of license plates available in Florida.

Form HSMV 83110. Application for Registration of a Motor Vehicle for Agricultural (Restricted), Horticultural (Restricted) License Plate - Florida

Form HSMV 83110 is an official application form used in Florida to register a motor vehicle for an agricultural or horticultural license plate. These specialized license plates are available for vehicles primarily used for agricultural or horticultural purposes.

Form HSMV 83109. Application for Legislative License Plate - Florida

Form HSMV 83109 is an official application form used in the state of Florida to apply for a legislative license plate. These license plates represent various organizations, causes, or special interests that are recognized by the Florida Legislature.

Form HSMV 83101. Missing License Plate, Decal or Placard Affidavit - Florida

The Form HSMV 83101 is utilized in Florida when an individual needs to report a missing, lost, stolen, or damaged license plate, decal, or disabled parking placard.

Form HSMV 83090. Application by Florida Motor Vehicle Mobile Home or Recreational Vehicle Dealer for Temporary Plates - Florida

The Form HSMV 83090 is used by motor vehicle, mobile home, or recreational vehicle dealers in Florida to apply for temporary license plates. The main purpose of this form is to allow dealers to legally transport and demonstrate vehicles that are not yet registered.

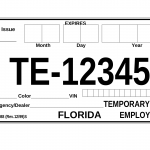

Form HSMV 83088. Temporary 90 Day Employment (Sample only do not fill out) - Florida

This form serves as a sample and should not be filled out for actual use. It relates to temporary employment in the state of Florida and provides an example of the information required when applying for a Temporary 90 Day Employment Authorization.

Form HSMV 83081. Application for a Press (PRES) License Plate - Florida

This form is used to apply for a Press License Plate in the state of Florida. The Press License Plate is issued to individuals or organizations in the media industry who require special identification while operating their vehicles for news gathering purposes.

Form HSMV 83065. Application for Transporter License Plate - Florida

Form HSMV 83065 is used to apply for a transporter license plate in Florida. The form allows individuals or businesses engaged in the business of transporting vehicles to obtain a specialized license plate for their transport vehicles.

Form HSMV 83045. Application for Registration of a Street Rod, Custom Vehicle, Horseless Carriage or Antique (Permanent) - Florida

Form HSMV 83045 is used to apply for the registration of special types of vehicles in Florida, including street rods, custom vehicles, horseless carriages, and antiques. The form allows owners of these vehicles to obtain permanent registration for their unique automobiles.