Form HSMV 84058. Vehicle Air Pollution Control Statement - Florida

Form HSMV 84058 is utilized in Florida to provide a statement regarding the air pollution control equipment of a vehicle. The form serves as a declaration that the vehicle complies with the state's air pollution control requirements.

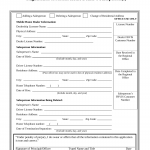

Form HSMV 84045. Registration of Mobile Home Dealer's Salesperson(s) - Florida

This form is utilized for registering the salesperson(s) of a mobile home dealer in the state of Florida. It is necessary for individuals who are involved in selling mobile homes on behalf of a licensed mobile home dealer.

The key components of this form include:

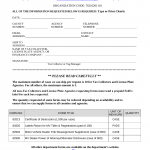

Form HSMV 84019. Application and Claim To Recover Compensation from the Mobile Home and Recreational Vehicle Trust Fund - Florida

Form HSMV 84019 is an application and claim form used in Florida to request compensation from the Mobile Home and Recreational Vehicle Trust Fund.

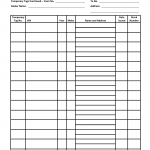

Form HSMV 84016. Temporary Tag Record - Florida

Form HSMV 84016 is a record form used in Florida to document the issuance and use of temporary tags for motor vehicles. This form serves as a record of temporary tag transactions and includes important details about the temporary tag issuance.

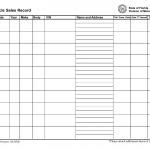

Form HSMV 84014. Vehicle Sales Record - Florida

Form HSMV 84014 is a record form used in Florida to document the sale of a motor vehicle. This form serves as a record of the transaction and contains important information regarding the vehicle sale.

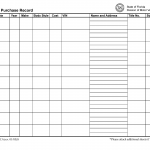

Form HSMV 84013. Vehicle Purchase Record - Florida

Form HSMV 84013 is a record form used in Florida to document the purchase of a motor vehicle. This form serves as a record of the transaction and includes important details about the vehicle purchase.

Form HSMV 83416. Request for Division of Motor Vehicle/Vessel Forms - Florida

Form HSMV 83416 is a request form used in Florida to obtain various motor vehicle and vessel forms issued by the Division of Motor Vehicles (DMV). This form allows individuals to request specific forms required for different transactions or purposes.

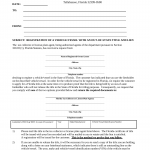

Form HSMV 83060. Registration of Vehicle with Out-Of-State Lien - Florida

Form HSMV 83060 is used to register a vehicle in Florida that has an out-of-state lien. The form allows individuals who have obtained a vehicle through financing or leasing outside of Florida to register it and establish the lienholder's interest in the vehicle.

Form HSMV 86020. Surety Bond, Motor Vehicle Dealer - Florida

Form HSMV 86020 is used in Florida by motor vehicle dealers to provide a surety bond as part of the licensing requirements. This form is specifically for dealers who need to obtain or renew their license to sell motor vehicles.

Form HSMV 86019. Surety Bond, Recreational Vehicle Dealer - Florida

Form HSMV 86019 is used in Florida by recreational vehicle dealers to provide a surety bond as part of the licensing requirements. This form is specifically for dealers who need to obtain or renew their license to sell recreational vehicles.