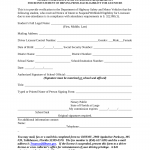

Form HSMV 72870. Student Notification for Driving Eligibility for Licensure - Florida

The Form HSMV 72870, referred to as the Student Notification for Driving Eligibility for Licensure, is used in Florida to notify students about their eligibility for obtaining a driver's license.

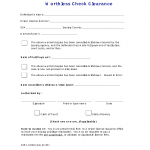

Form HSMV 72862. Worthless Check Clearance - Florida

The Form HSMV 72862, known as the Worthless Check Clearance form, is used in Florida to resolve outstanding issues related to bounced or worthless checks issued for payment of motor vehicle-related fees.

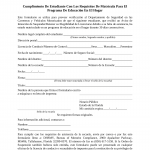

Form HSMV 72836. NotificaciГіn a Estudiante para Programa de EducaciГіn en el Hogar - Florida

The Form HSMV 72836, known as NotificaciГіn a Estudiante para Programa de EducaciГіn en el Hogar, is used in Florida within the context of homeschooling.

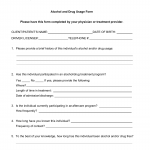

Form HSMV 72480. Alcohol and Drug Usage Form - Florida

The Form HSMV 72480, referred to as the Alcohol and Drug Usage Form, is used in Florida to gather information regarding an individual's alcohol or drug usage history.

Form HSMV 72423. Medical Report - Florida

The Form HSMV 72423, known as the Medical Report, is used in Florida to report an individual's medical condition or impairment that may affect their ability to safely operate a motor vehicle.

Form HSMV 72201. FRTP Rules of Professional Conduct - Florida

The Form HSMV 72201, known as the FRTP Rules of Professional Conduct, is utilized in Florida within the context of the Financial Responsibility Traffic School (FRTP).

Form HSMV 72190. Report a Driver Whose Ability is Questionable - Florida

The Form HSMV 72190, referred to as the Report a Driver Whose Ability is Questionable, is used in Florida to report concerns about an individual's ability to safely operate a motor vehicle.

Form HSMV 72120. Application for Developmental Disability Designation - Florida

The Form HSMV 72120, also known as the Application for Developmental Disability Designation, is used in Florida to request a designation for individuals with developmental disabilities.

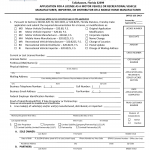

Form HSMV 84256. Application for a License as a Motor Vehicle or Recreational Vehicle Manufacturer, Importer, or Distributor or a Mobile Home Manufacturer - Florida

Form HSMV 84256 is utilized in Florida by individuals or businesses seeking to obtain a license as a motor vehicle or recreational vehicle manufacturer, importer, distributor, or mobile home manufacturer.

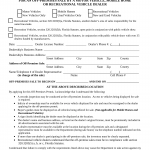

Form HSMV 84200. Application for A Temporary Supplemental License for An Off-Premises Sale by A Motor Vehicle, Mobile Home or Recreational Vehicle Dealer - Florida

Form HSMV 84200 is used in Florida by motor vehicle, mobile home, or recreational vehicle dealers to apply for a temporary supplemental license for off-premises sales. This form allows dealers to conduct sales at locations other than their licensed premises temporarily.