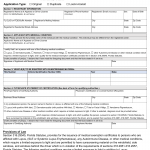

Form HSMV 84901. Complaint Affidavit - Florida

Form HSMV 84901 is used in Florida as a complaint affidavit to report violations or offenses related to motor vehicles. This form allows individuals to formally document complaints and provide supporting information regarding incidents they have witnessed or experienced.

Form HSMV 84491. Statement of Builder (Additional Sheet) - Florida

Form HSMV 84491 is an additional sheet used in conjunction with Form HSMV 84490, the Statement of Builder. This form provides extra space for builders to provide detailed information about the assembly or reconstruction process when the space provided on Form HSMV 84490 is insufficient.

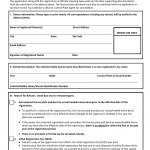

Form HSMV 84490. Statement of Builder - Florida

Form HSMV 84490 is used in Florida as a statement of builder for vehicles that are assembled or reconstructed by an individual or business. This form is typically required when registering or titling custom-built or reconstructed vehicles.

Form HSMV 84050. Application for Dealer License Reprint - Florida

Form HSMV 84050 is used in Florida to apply for a reprint of a dealer license. The form is intended for dealerships who need to replace a lost, damaged, or stolen dealer license.

The form consists of several sections and important fields, including:

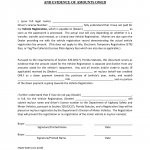

Form HSMV 84026. Assignment of Claim/Suit - Florida

This form is used for the assignment of a claim or lawsuit in the state of Florida. It is typically used when transferring the rights and responsibilities of a claim or a lawsuit from one party to another.

The form consists of several important fields, including:

Form HSMV 83390. Application for Sunscreening Medical Exemption - Florida

Form HSMV 83390 is an application form used in Florida to request a medical exemption for sunscreening on motor vehicles. This form allows individuals with specific medical conditions to apply for an exemption from the restrictions regarding darkened window tinting.

Form HSMV 83363. Application for License Plate or Decal Refund - Florida

Form HSMV 83363 is an application form used in Florida to request a refund for license plates or decals. This form allows individuals to claim a refund for overpayment, duplicate payments, or underutilized license plates or decals.

Form HSMV 83351. Cash On Delivery Unpaid Fees - Florida

Form HSMV 83351 is an official document used in Florida for the collection of unpaid fees associated with a motor vehicle. This form is commonly referred to as the "Cash On Delivery" (COD) form.

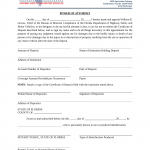

Form HSMV 83345. Certificate of Deposit Power of Attorney - Florida

Form HSMV 83345 is an official document known as the Certificate of Deposit Power of Attorney. This form is used in Florida to grant power of attorney to an individual specifically for the purpose of managing a certificate of deposit (CD) related to a motor vehicle.

Form HSMV 83330. Florida Insurance Affidavit - Florida

Form HSMV 83330 is an official document known as the Florida Insurance Affidavit. This form is used in the state of Florida to provide proof of insurance coverage for a motor vehicle.