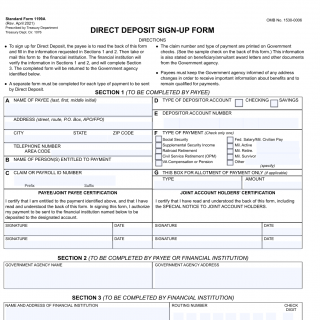

SF 1199A. Direct Deposit Sign-Up Form

The SF 1199A Direct Deposit Sign-Up Form is a standardized U.S. Treasury Department form that allows individuals to receive federal payments electronically. Instead of paper checks, this form enables secure and efficient deposits directly to a checking or savings account. It is commonly used by federal employees, retirees, Social Security beneficiaries, and anyone receiving payments from the U.S. government.

By completing this fillable PDF form, applicants provide essential details such as their name, Social Security Number, type of payment (e.g., salary, pension, benefits), and their financial institution’s routing and account numbers. The form must then be certified by the bank and submitted to the appropriate government agency. This ensures accuracy and compliance with federal direct deposit regulations (31 CFR Parts 240, 208, and 210).

The SF 1199A form is available in fillable, printable, and downloadable formats (PDF and DOCX). It includes clear instructions for both payees and financial institutions, making it easy to complete and submit. Using this official government form template eliminates delays, reduces the risk of lost checks, and helps beneficiaries receive funds on time.

Whether you are enrolling for the first time or updating your banking information, this form provides a reliable and secure way to manage your direct deposit application.