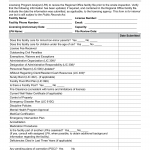

Form LIC 9235. Facility Inspection Checklist Short - Term Residential Therapeutic Program - California

Form LIC 9235 is used in California by licensing agencies to conduct inspections of short-term residential therapeutic programs. This form is completed by licensing inspectors during their site visits to evaluate the compliance of these programs with regulatory requirements.

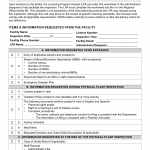

Form LIC 9236. Entrance Checklist Short - Term Residential Therapeutic Program - California

Form LIC 9236 is used in California by short-term residential therapeutic programs to document and track the process of admitting a client into their program. This form is completed by program personnel when welcoming a new client to the short-term residential therapeutic program.

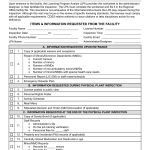

Form LIC 9239 CCH. Entrance Checklist - Community Crisis Homes - California

Form LIC 9239 CCH is used in California by community crisis homes to document and track the process of admitting an individual or family into their program.

Form LIC 9239 CN. Entrance Checklist - Crisis Nurseries - California

Form LIC 9239 CN is used in California by crisis nurseries to document and track the process of admitting a child or children into their facility. This form is completed by crisis nursery personnel when accepting a child for temporary care during times of family crisis or emergency.

Form LIC 9239 CTF. Entrance Checklist Community Treatment Facility - California

Form LIC 9239 CTF is used in California by community treatment facilities to document and track the process of admitting an individual into their program. This form is completed by facility personnel when accepting an individual for community-based treatment and support.

Form LIC 9239 EBSH. Entrance Checklist - Enhanced Behavioral Supports Homes - California

Form LIC 9239 EBSH is used in California by enhanced behavioral supports homes (EBSH) to document and track the process of admitting an individual with behavioral support needs into their home.

Form LIC 9239 TrSCF. Entrance Checklist - Transitional Shelter Care Facility - California

Form LIC 9239 TrSCF is used in California by transitional shelter care facilities to document and track the process of admitting a youth into their facility. This form is completed by facility personnel when accepting a youth for temporary shelter and support during transitional periods.

Form LIC 9239 YHPC. Entrance Checklist - Youth Homelessness Prevention Center - California

Form LIC 9239 YHPC is used in California by youth homelessness prevention centers to document and track the process of admitting a youth into their program. This form is completed by center personnel when providing support and services to youth at risk of homelessness.

Form LIC 9239. Entrance Checklist Group Home - California

Form LIC 9239 is a general entrance checklist form used in California by group homes to document and track the process of admitting an individual into their facility. This form is completed by group home personnel when welcoming a new resident.

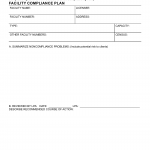

Form LIC 9112. Facility Compliance Plan - California

Form LIC 9112 serves as a Facility Compliance Plan for various licensed facilities in California. This form is used to outline a comprehensive plan that ensures compliance with the relevant regulations and requirements governing the operation of the facility.