Form LIC 9221. Parent Consent For Administration Of Medications And Medication Chart - California

Form LIC 9221 is used in California by child care facilities to obtain parental consent for the administration of medications to children under their care. This form is completed by parents or guardians when they authorize the facility staff to administer medications to their child.

Form LIC 9222. Blood Glucose Testing Consent/Verification Child Care Facilities - California

Form LIC 9222 is used in California by child care facilities to obtain consent and verification for blood glucose testing for children with diabetes. This form is completed by parents or guardians to authorize the facility staff to perform blood glucose testing on their child.

Form LIC 9223. Child Care Advocate Program - California

Form LIC 9223 is used in California for individuals or organizations interested in participating in the Child Care Advocate Program. This program allows advocates to assist families in navigating the child care system and accessing available resources.

Form LIC 9224. Acknowledgement Of Receipt Of Licensing Reports - California

Form LIC 9224 is used in California to acknowledge the receipt of licensing reports by licensed facilities regulated by Community Care Licensing.

Form LIC 9225. Pre-Placement Questionnaire - California

Form LIC 9225 is used in California by licensed facilities or agencies involved in the placement of children to gather information about prospective caregivers or families.

Form LIC 9226. Request For Training Approval: Mandated Child Abuse Reporter Training - California

Form LIC 9226 is used in California by individuals or organizations seeking approval for mandated Child Abuse Reporter Training. This form is completed by individuals who are required to undergo training to fulfill their legal obligations as mandated reporters of child abuse.

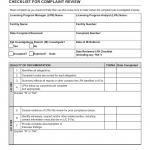

Form LIC 9229. Licensing Program Manager (LPM) Checklist For Complaint Review - California

Form LIC 9229 is used in California by Licensing Program Managers (LPMs) to review and document their assessment of complaints received regarding licensed facilities. This form is completed by LPMs who are responsible for investigating and resolving complaints related to licensed facilities.

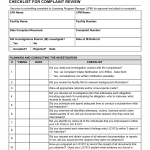

Form LIC 9230. Licensing Program Analyst (LPA) Checklist For Complaint Review - California

Form LIC 9230 is used in California by Licensing Program Analysts (LPAs) to review and document their assessment of complaints received regarding licensed facilities. This form is completed by LPAs who are responsible for investigating and resolving complaints related to licensed facilities.

Form LIC 9233. Facility Inspection Checklist Foster Family Agencies - California

Form LIC 9233 is used in California by licensing agencies to conduct inspections of foster family agencies. This form is completed by licensing inspectors during their site visits to evaluate the compliance of foster family agencies with regulatory requirements.

Form LIC 9234. Entrance Checklist Foster Family Agency - California

Form LIC 9234 is used in California by foster family agencies to document and track the process of admitting a child into their program. This form is completed by agency personnel when welcoming a new child to the foster family agency.