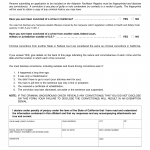

Form LIC 421D (CC). Civil Penalty Assessment - Death/Serious Injury/Physical Abuse (Child Care) - California

Form LIC 421D (CC) is used in California to assess civil penalties against licensed child care facilities or programs in cases involving death, serious injury, or physical abuse.

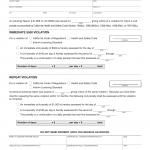

Form LIC 421D (CRP). Civil Penalty Assessment - Death/Serious Bodily Injury/Physical Abuse (CRP) - California

Form LIC 421D (CRP) is used in California to assess civil penalties against Community Care facilities (such as adult residential facilities and group homes) in cases involving death, serious bodily injury, or physical abuse.

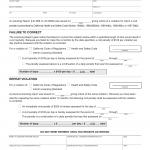

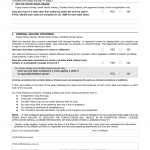

Form LIC 421FC. Civil Penalty Assessment - Failure To Correct And Repeat Violations - California

Form LIC 421FC is used in California to assess civil penalties against licensed facilities or programs that have failed to correct violations or have repeated violations.

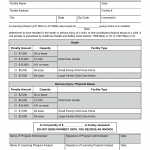

Form LIC 421IM. Civil Penalty Assessment - Immediate $500 And Repeat Violations - California

Form LIC 421IM is used in California to assess civil penalties against licensed facilities or programs for immediate violations and repeat offenses.

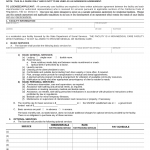

Form LIC 500. Personnel Report - California

Form LIC 500 is used in California to report personnel information for individuals working in licensed facilities or programs. The main purpose of this form is to ensure accurate documentation of the facility's staff members and their qualifications as required by licensing regulations.

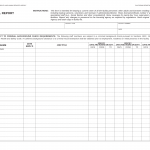

Form LIC 507. Facilities Staff Work Schedule - California

Form LIC 507 is used in California to document the work schedules of staff members in licensed facilities or programs. The main purpose of this form is to ensure proper staffing levels and compliance with licensing regulations regarding staff-to-individual ratios.

Form LIC 508A. Criminal Record Statement - Adoption Facilitator - California

Form LIC 508A is used in California by adoption facilitators to disclose their criminal records and provide information regarding their suitability to participate in adoption-related activities.

Form LIC 508B. Criminal Record Statement - Long-Term Care Ombudsman Program - California

Form LIC 508B is used in California by individuals applying to become part of the Long-Term Care Ombudsman Program to disclose their criminal records.

Form LIC 508D. Out-Of-State Disclosure And Criminal Record Statement - California

Form LIC 508D is used in California by individuals who have lived out-of-state and are applying for employment or certification within certain regulated industries. The main purpose of this form is to disclose any criminal record history from their time living out-of-state.

Form LIC 604. Admission Agreement Guide For Residential Facilities - California

Form LIC 604 is used in California by residential facilities to provide an admission agreement guide to individuals seeking residency. The main purpose of this form is to ensure transparency and clarity regarding the terms, conditions, and rights of residents upon admission.