Real estate becomes part of the Form 706 process when the decedent owned, or had a legally enforceable interest in, land or buildings at the time of death. Within the estate tax system, real property is treated as a distinct category of assets because its valuation, ownership structure, and inclusion rules differ from those that apply to financial assets. Reporting real estate allows the Internal Revenue Service to determine how immovable property contributes to the gross estate and how its value affects the overall tax position.

Why real estate is reported separately

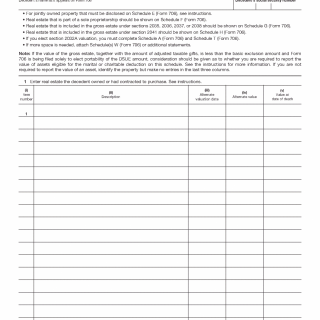

The estate tax system classifies property by type so that appropriate valuation and inclusion rules can be applied. Real estate is reported separately because it often involves unique ownership arrangements, location-based valuation issues, and statutory cross-references that determine whether the property is fully includible in the gross estate.

The formal role of Form 706 and its schedules is defined on the IRS Form 706 document page, which describes how individual schedules fit into the official structure of the return.

When real estate is included in the gross estate

Real property is included in the gross estate when the decedent held ownership or certain contractual rights at death. This includes property held individually, as well as real estate subject to specific inclusion provisions that bring assets back into the estate even if legal title was transferred earlier.

In some cases, real estate connected to business activities, lifetime transfers, or powers of appointment may be reported on different schedules depending on how the system classifies the interest. The determination of which schedule applies reflects how the estate tax rules evaluate control and economic benefit rather than simple title.

How real estate is valued for estate tax purposes

For estate tax purposes, real estate is generally valued based on its fair market value as of the date of death or an alternate valuation date when applicable. This valuation establishes the amount that flows into the gross estate calculation and influences subsequent deductions, credits, and exclusions.

The valuation of real estate interacts with later stages of the Form 706 process, including the reduction of the estate through debts and expenses and the application of marital or charitable deductions.

Interaction with debts, expenses, and deductions

Real estate reported in the estate may be subject to mortgages, liens, or administration expenses that reduce the taxable estate. These obligations are not netted directly on the real estate schedule but are applied later in the process as part of the system’s structured reduction of the gross estate.

The treatment of these reductions is explained in estate expenses and debts under Form 706.

How this schedule fits into the overall filing process

The reporting of real estate is one step within the broader Form 706 filing sequence. Once real property is identified and valued, the estate moves forward to incorporate other asset categories, apply deductions, and determine the final estate tax outcome.

An overview of how this step fits into the full filing sequence is provided in how the Form 706 filing process works, while the central hub for all related scenarios is available in the Form 706 overview.