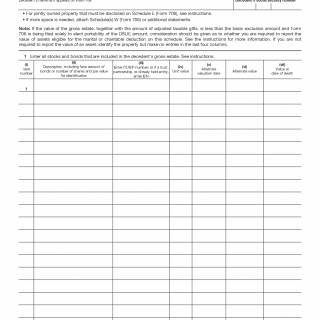

Stocks, bonds, and similar marketable securities become part of the Form 706 process when the decedent held ownership interests in publicly traded or closely held financial instruments at the time of death. Within the estate tax system, these assets are treated as a distinct class because their valuation, ownership evidence, and market behavior differ from real property and other nonfinancial assets. Reporting these securities allows the Internal Revenue Service to determine how financial holdings contribute to the gross estate.

Why stocks and bonds are reported on a separate schedule

The estate tax system separates financial securities from other asset categories to apply valuation rules that reflect market pricing and transferability. Stocks and bonds often have readily determinable values based on market data, but ownership form, restrictions, and valuation dates still affect how the system measures their inclusion.

The official structure of Form 706 and the role of each schedule within that structure are defined on the IRS Form 706 document page.

When securities are included in the gross estate

Securities are included in the gross estate when the decedent owned the interest outright or retained sufficient control or economic benefit at death. This includes shares and bonds held individually, jointly in certain arrangements, or through entities where estate tax rules require inclusion based on retained rights.

In some situations, securities connected to jointly owned property, trusts, or lifetime transfers may be reported on different schedules depending on how the system classifies the interest.

Valuation of stocks and bonds for estate tax purposes

For estate tax purposes, marketable securities are generally valued using fair market value as of the date of death or an alternate valuation date when permitted. This valuation establishes the amount that flows into the gross estate and directly affects later deductions, credits, and exclusions.

Because these values are integrated into the overall estate calculation, changes in valuation can influence whether filing thresholds are met and how subsequent tax positions are determined.

Interaction with expenses, deductions, and later stages

Securities included in the estate may be subject to debts, expenses, or transfer-related deductions that reduce the taxable estate. These adjustments are applied after asset valuation as part of the system’s structured reduction process rather than directly on the securities schedule.

The treatment of these reductions is explained in estate expenses and debts under Form 706.

How this schedule fits into the overall Form 706 process

The reporting of stocks and bonds represents one stage in the broader Form 706 filing sequence. After financial assets are identified and valued, the estate proceeds to integrate other asset classes, apply deductions, and calculate estate and generation-skipping transfer tax consequences.

The full sequence in which this step occurs is described in how the Form 706 filing process works, and the complete context for all related scenarios is available in the Form 706 overview.