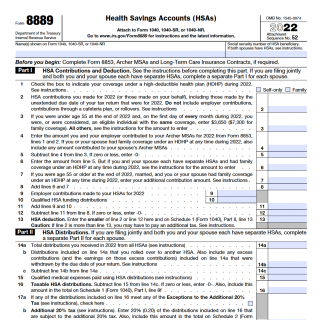

IRS Form 8889. Health Savings Accounts

IRS Form 8889 is a tax form used to report contributions to and distributions from Health Savings Accounts (HSAs).

The form consists of four parts:

- Part I - Health Savings Accounts (HSAs)

- Part II - Archer MSAs and Long-Term Care Insurance Contracts

- Part III - HSA Contributions

- Part IV - HSA Distributions

Part I is used to report information about the HSA account holder, including their name, address, and social security number. Part II is used to report information about Archer Medical Savings Accounts (MSAs) and long-term care insurance contracts. Part III is used to report contributions made to the HSA account during the tax year. Part IV is used to report distributions made from the HSA account during the tax year.

This form is drawn up by taxpayers who have contributed to or taken distributions from an HSA account during the tax year. The parties involved in this form are the taxpayer and the HSA account holder.

When compiling this form, it is important to consider the contribution limits for the tax year, the types of expenses that are eligible for reimbursement with HSA funds, and the rules for rollovers and transfers between HSA accounts.

Real cases of using this form include taxpayers who have contributed to or taken distributions from an HSA account during the tax year. For example, a taxpayer who has contributed to their HSA account and used the funds to pay for qualified medical expenses would need to report these contributions and distributions on Form 8889.

The advantages of this form include tax benefits for contributions made to an HSA account, the ability to use HSA funds to pay for qualified medical expenses tax-free, and the flexibility to roll over or transfer funds between HSA accounts. The potential problems that can occur if the form is filled out incorrectly include penalties and fines for non-compliance with applicable laws and regulations.