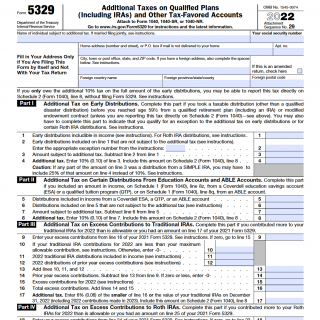

IRS Form 5329. Additional Taxes on Qualified Plans

Form 5329 is an IRS tax form that is used to report additional taxes on certain qualified retirement plans, including IRAs, SEPs, and SIMPLE plans. The form is used to report early distributions, excess contributions, and other penalties that apply to retirement plans.

The form consists of several parts, including identifying information about the taxpayer, a summary of the additional taxes owed, and any exemptions that may apply. Each section requires specific information to be provided, such as the type of additional tax, the amount of the additional tax, and the reason for the additional tax.

Form 5329 is drawn up by the taxpayer or their tax preparer and is typically filed with their annual tax return. The parties involved in the form are the taxpayer and the IRS.

Form 5329 is drawn up in cases where the taxpayer has made an early distribution from a qualified retirement plan, has made excess contributions to a qualified retirement plan, or has failed to take required minimum distributions from a qualified retirement plan.

When compiling Form 5329, it is important to ensure that all information is accurate and complete. This includes ensuring that the correct identifying information is provided, that the type and amount of the additional tax are accurately reported, and that any exemptions or special circumstances are accurately reported.

Real cases of using Form 5329 include reporting early distributions from an IRA, reporting excess contributions to a SEP, and reporting failure to take required minimum distributions from a SIMPLE plan. The advantages of Form 5329 include providing an accurate record of additional taxes owed on qualified retirement plans, which can be used to calculate taxes owed and ensure compliance with applicable laws and regulations. However, if the form is filled out incorrectly or filed late, there can be penalties and additional taxes owed. It is important to consult with a tax professional or financial advisor if you have any questions or concerns about completing Form 5329.