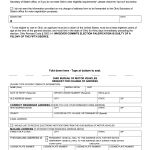

Form BMV 3772. Application for Dealer Assignment

The BMV 3772, also known as the "Application for Dealer Assignment" form, is a crucial document provided by the Ohio Bureau of Motor Vehicles (BMV). This form serves the purpose of facilitating the assignment of a dealer to a specific vehicle transaction.

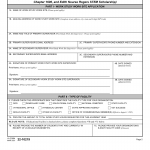

Form BMV 3811. Affidavit for Designation of Beneficiary or Beneficiaries by the Sole Owner for a Motor Vehicle, Watercraft, or Outboard Motor Certificate of Title

The BMV 3811 form, also known as the Affidavit for Designation of Beneficiary or Beneficiaries by the Sole Owner for a Motor Vehicle, Watercraft, or Outboard Motor Certificate of Title, is a document provided by the Ohio Bureau of Motor Vehicles (BMV).

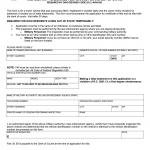

VA Form 10-305. Your Rights to Seek Further Review of PCAFC Decisions

The VA Form 10-305, titled "Your Rights to Seek Further Review of PCAFC Decisions", is an important document provided by the Department of Veterans Affairs (VA) to inform individuals about their rights and options for seeking further review of decisions made by the Physical Disability Board of Re

Form BMV 5756. Request for Change of Address

The BMV 5756 form, provided by the Ohio Bureau of Motor Vehicles (BMV), is an essential document for individuals who need to request a change of address in Ohio.

VA Form 22-10219. Department of Veterans Affairs Work Study Work Site Application

The VA Form 22-10219 Department of Veterans Affairs Work Study Work Site Application is a crucial document used by veterans in the United States who are seeking to participate in the VA's Work-Study Program.

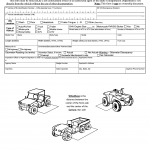

Form BMV 3787. Motor Vehicle Physical Inspection for Ohio Residents and Military Personnel Temporarily Living Out-of-State

The BMV 3787 form, also known as the "Motor Vehicle Physical Inspection for Ohio Residents and Military Personnel Temporarily Living Out-of-State," is a document provided by the Ohio Bureau of Motor Vehicles (BMV).

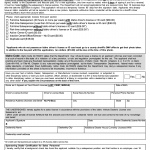

Form BMV 3774. Applications for Certificate of Title to a Motor Vehicle

The BMV 3774 form, also known as the "Application for Certificate of Title to a Motor Vehicle," is a crucial document used by the Ohio Bureau of Motor Vehicles (BMV). This form serves the purpose of applying for a certificate of title for a motor vehicle in the state of Ohio.

Ohio Bureau of Motor Vehicles (BMV) Forms

The Ohio Bureau of Motor Vehicles (BMV) provides a comprehensive range of forms to accommodate various needs and circumstances related to vehicle ownership, insurance, legal documentation, and more.

Form ITD 3171. Personal History and Application for Salesperson license

The ITD 3171 form, known as the Personal History and Application for Salesperson License, is a crucial document used by the Idaho Department of Motor Vehicles (DMV) for individuals applying for a salesperson license.

Form ITD 3403. Vehicle Identification Number Inspection Certification

The ITD 3403 form, known as the Vehicle Identification Number Inspection Certification, is an essential document used by the Idaho Department of Motor Vehicles (DMV) for certifying the inspection of a vehicle's identification number.