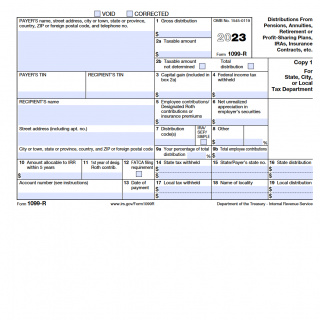

IRS Form 1099-R. 2023.

Form 1099-R is an IRS tax form that reports distributions from pensions, annuities, retirement plans, IRAs, and other similar accounts. The form is typically issued by the payer of the distribution and is used to report the total amount of the distribution, the taxable amount, and any federal income tax withheld.

The form consists of several parts, including identifying information about the payer and the recipient of the distribution, a summary of the distribution, and a summary of any federal income tax withheld. Each section requires specific information to be provided, such as the amount of the distribution, the taxable amount, and the amount of federal income tax withheld.

Form 1099-R is drawn up by the payer of the distribution and is typically issued to the recipient by January 31st of the year following the calendar year to which the form relates. The parties involved in the form are the payer of the distribution and the recipient of the distribution.

Form 1099-R is drawn up in cases where the payer has made a designated distribution or is treated as having made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, pensions, insurance contracts, survivor income benefit plans, permanent and total disability payments under life insurance contracts, charitable gift annuities, etc.

When compiling Form 1099-R, it is important to ensure that all information is accurate and complete. This includes ensuring that the correct identifying information is provided, that the total amount of the distribution and the taxable amount are accurately reported, and that any federal income tax withheld is accurately reported.

Real cases of using Form 1099-R include reporting distributions from a pension plan, reporting distributions from an IRA, reporting distributions from an annuity, and reporting distributions from a retirement plan. The advantages of Form 1099-R include providing an accurate record of distributions made from pension plans, annuities, retirement plans, and IRAs, which can be used to calculate taxes owed and ensure compliance with applicable laws and regulations. However, if the form is filled out incorrectly or filed late, there can be penalties and additional taxes owed. It is important to consult with a tax professional or financial advisor if you have any questions or concerns about completing Form 1099-R.