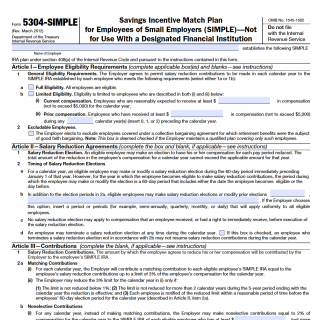

IRS Form 5304-SIMPLE. Savings Incentive Match Plan for Employees of Small Employers

IRS Form 5304-SIMPLE is a form that is used to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA plan. This form is used by employers to establish a SIMPLE IRA plan for their employees.

The form consists of three parts:

- Part I - Salary Reduction Simplified Employee Pension Plan Agreement

- Part II - Information About the SIMPLE IRA Plan

- Part III - Notification to Employees

Part I is used to establish the salary reduction arrangement between the employer and the employee. Part II contains information about the SIMPLE IRA plan, such as the name and address of the employer, the plan year, and the contribution rate. Part III is used to notify employees of the SIMPLE IRA plan.

This form is drawn up by employers who want to establish a SIMPLE IRA plan for their employees. The parties involved in this form are the employer and the employees who are eligible to participate in the SIMPLE IRA plan.

When compiling this form, it is important to consider the eligibility requirements for employees, the contribution rate, and the contribution limits. The employer must also ensure that the plan is in compliance with all applicable laws and regulations.

Real cases of using this form include small business owners who want to provide a retirement plan for their employees. By establishing a SIMPLE IRA plan, employers can make contributions to their employees' retirement accounts and receive tax benefits for doing so.

The advantages of this form include tax benefits for both the employer and the employee, simple and easy to establish, and flexible contribution options. The potential problems that can occur if the form is filled out incorrectly include penalties and fines for non-compliance with applicable laws and regulations.