Banking Power of Attorney

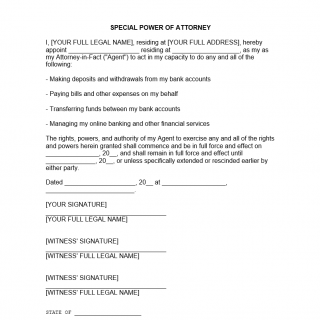

A Banking Power of Attorney is a legal document that grants an agent or attorney-in-fact the specific legal authority to manage the financial affairs of the principal. This form typically comprises several sections, including:

- Identification of the parties: The Banking Power of Attorney will typically begin by identifying the parties involved, including the principal and the agent, as well as any witnesses who may be required to sign the document.

- Powers granted to the agent: This section will describe in detail the specific financial powers that the principal is granting to the agent, such as access to bank accounts, the ability to withdraw funds, and the power to make financial investments.

- Limitations on the agent's powers: This section will outline any limitations or restrictions on the agent's powers, such as restrictions on transactions over a certain dollar amount or limitations on the duration of the power of attorney.

- Term and Termination: This section will specify the duration of the Banking Power of Attorney, including when it will begin and end. It may also include provisions outlining when and how the power of attorney can be revoked.

A Banking Power of Attorney can be drawn up in several cases, such as when the principal is unable to manage their own finances, perhaps due to illness or disability, or when the principal will be out of the country for an extended period of time. The parties involved in this form are the principal and the agent who is authorized to handle their financial affairs.

When compiling this form, it is important to provide detailed instructions regarding the agent's authority and any limitations on that authority. It is also important to clearly define the agent's responsibilities and fiduciary obligations to the principal. Legal assistance may be necessary to ensure that the document is properly drafted and complies with applicable laws.

The advantages of using a Banking Power of Attorney are that it can provide the principal with the peace of mind of knowing that their financial affairs are being handled by someone they trust, and that it can often make things more efficient by allowing the agent to handle specific financial transactions or matters. However, there can be problems if the form is filled out incorrectly or with vague language, which could lead to misunderstandings or disputes between the principal and the agent. It is important to work with an attorney or experienced legal professional to ensure that the document is appropriately created and meets all legal requirements.