Insurance Power of Attorney

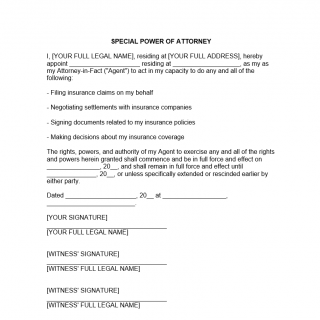

An Insurance Power of Attorney is a legal document that grants an individual or organization the power to act on behalf of another person in insurance matters. The document consists of several parts.

First, the document identifies the parties involved, including the individual granting power of attorney, the agent or attorney-in-fact, the insurance company or companies involved, and any other relevant entities or persons involved in any insurance-related matters.

The document also specifies the powers granted to the agent, which may include the ability to make decisions related to insurance claims, receive and approve or deny communications from insurers, sign insurance-related documents, and handle any other insurance-related matters.

The Insurance Power of Attorney may be drawn up in cases where the individual granting power of attorney is facing a serious medical condition, incapacity, or other circumstances that prevent them from managing their insurance matters on their own.

The parties involved in the document are the individual granting power of attorney, the agent authorized to act on their behalf, and the insurance companies or other relevant entities involved in insurance matters.

When compiling the Insurance Power of Attorney, it is essential to ensure that the document accurately identifies the individual granting power of attorney and the insurance companies and other entities involved in insurance matters. It is also critical to ensure that the document authorizes the appropriate scope of power and includes any necessary limitations or restrictions. Additionally, it is essential to ensure that the document complies with all relevant laws and regulations regarding insurance matters.

The advantages of this form include giving the individual flexibility to delegate power to a trusted agent and ensuring that their insurance matters are managed appropriately. It can also provide peace of mind to individuals who may be facing serious medical conditions or incapacity, knowing that their insurance matters will be handled appropriately.

However, any error or ambiguity in the document could lead to confusion, disputes, or legal challenges, especially if it does not comply with relevant laws and regulations. It is always recommended to consult with an attorney experienced in insurance law to ensure that the document is appropriately prepared and meets all legal requirements.