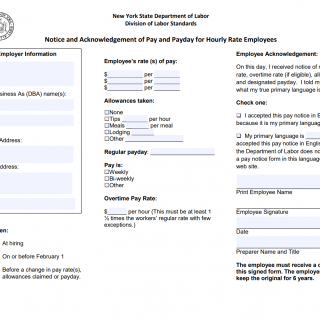

Form LS 54. Notice and Acknowledgement of Pay and Payday for Hourly Rate Employees

The LS 54 Form is a notice and acknowledgement form required by the New York State Department of Labor's Division of Labor Standards. The purpose of the form is to notify hourly rate employees of their pay rate and payday and to obtain their acknowledgement of this information.

The LS 54 Form consists of two parts: Part A, which is completed by the employer and provides information about the employee's pay rate and payday, and Part B, which is completed by the employee and acknowledges their receipt and understanding of the information provided in Part A.

Important fields to consider when completing the LS 54 Form include the employee's name, address, and Social Security number, as well as their hourly pay rate and payday. It is important for employers to accurately complete Part A of the form and to provide clear and concise information to their employees.

When completing Part B of the form, employees must acknowledge that they have received and understand the information provided in Part A. Employees should carefully review the information provided and ask their employer any questions they may have before signing the form.

No additional documents need to be attached when submitting the LS 54 Form.

Examples of application and use cases for the LS 54 Form include employers who have hired new hourly rate employees or who are changing the pay rate or payday for existing hourly rate employees.

Strengths of the LS 54 Form include its ability to ensure that employees are aware of their pay rate and payday and to provide a record of their acknowledgement of this information. Weaknesses may include the potential for errors or confusion if the employer provides inaccurate or unclear information.

Related and alternative forms to the LS 54 Form include the DLSE-NTE Form, which is used to provide notice to employees of their rights under California law, and the W-2 Form, which is used to report wages and taxes withheld to the IRS. The main difference between these forms is the type of information being provided or reported.

To fill and submit the LS 54 Form, employers should complete Part A of the form and provide it to their hourly rate employees. Employees should carefully review the information provided and sign Part B of the form to acknowledge their receipt and understanding of the information. The form should be stored in the employee's personnel file for future reference.