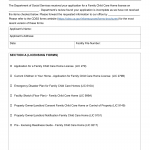

Form LIC 126. Entrance Checklist - Family Child Care Homes - California

Form LIC 126 is an entrance checklist specifically designed for Family Child Care Homes in California. Its main purpose is to assess and document the compliance of a family child care home with the licensing regulations prior to admission.

Form LIC 165. Board Of Directors Statement - California

Form LIC 165 is a statement form used in California by the Board of Directors of a licensed facility or organization. Its main purpose is to provide a formal statement from the Board of Directors affirming their support and responsibility for the operations and compliance of the facility.

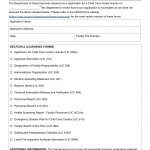

Form LIC 184B. Notification Of Incomplete Application - Family Child Care Home - California

Form LIC 184B is a notification form used in California for incomplete applications specifically related to Family Child Care Homes. Its main purpose is to inform the applicant that their application is missing required information or documentation.

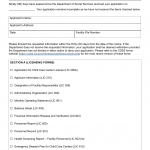

Form LIC 184C. Notification Of Incomplete Application (NOIA) Child Care Centers -В Pre-30-Day NOIA - California

Form LIC 184C is a notification form used in California for incomplete applications related to Child Care Centers. Its main purpose is to notify the applicant of an incomplete application and request the missing information or documentation.

Form LIC 184D. Notification Of Incomplete Application (NOIA) Child Care Centers - 30-Day NOIA - California

Form LIC 184D is a notification form used in California for incomplete applications related to Child Care Centers. Its main purpose is to notify the applicant of an incomplete application and provide a 30-day timeframe to complete the missing requirements.

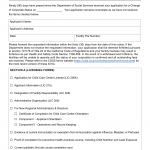

Form LIC 184E. Notice Of Incomplete Application (NOIA) Changes To Corporate Status - California

This form, Form LIC 184E, is a notice used in California to inform an applicant of an incomplete application specifically related to changes in corporate status.

Form LIC 195. Notice Of Operation In Violation Of Law - California

Form LIC 195 is a notice form used in California to inform a facility or organization operating in violation of applicable laws, regulations, or licensing requirements.

Form LIC 195A. Notice Of Operation In Violation Of Law - Family Child Care Home - California

Form LIC 195A is a notice form used in California specifically for Family Child Care Homes that are operating in violation of applicable laws, regulations, or licensing requirements.

Form LIC 198. Child Abuse Central Index Check For County Licensed Facilities - California

Form LIC 198 is used in California to conduct a Child Abuse Central Index (CACI) check for county licensed facilities. Its main purpose is to determine if there are any documented reports of child abuse or neglect involving the applicant or individuals associated with the facility.

Form LIC 198B. Out-Of-State Child Abuse/Neglect Report Request - California

Form LIC 198B is used in California to request out-of-state child abuse or neglect reports. Its main purpose is to gather information about an individual's history of child abuse or neglect from other states or jurisdictions.