ATF Form 3. Application for Tax-Exempt Transfer of Firearm and Registration to Special Occupational Taxpayer NFA (ATF Form 5320.3)

The Form 3 - Application for Tax-Exempt Transfer of Firearm and Registration to Special Occupational Taxpayer (National Firearms Act) (ATF Form 5320.3) is a document used by individuals who wish to transfer a firearm tax-exempt to another special occupational taxpayer.

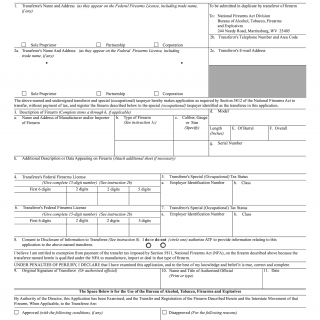

This form consists of several parts, including personal information about the transferor and transferee, details about the firearm being transferred, and certification by the applicant. Important fields to consider when compiling/filling out the form include the type of firearm, caliber, barrel length, overall length, and serial number.

The parties involved in the completion of this form include the transferor, transferee, and the ATF. It is important to note that any false statements made on the form can result in criminal charges.

When compiling/filling out the form, the transferor and transferee will need to provide personal information such as their name, address, and federal firearms license (FFL) number. Additionally, they will need to provide details about the firearm, including its type, caliber, barrel length, and overall length. Supporting documents that must be attached to the application include photocopies of the FFL and a certification of compliance with state and local laws.

Examples of when this form may be needed include when a licensed firearms dealer wants to transfer a firearm tax-exempt to another licensed dealer. It is important to note that the process of obtaining approval for this form can take several weeks.

Strengths of this form include the fact that it helps to regulate the transfer of firearms between licensed dealers, which can help to prevent illegal activity. Weaknesses include the potential for errors on the form, which can result in legal issues.

Alternative forms related to this include Form 4, which is used for the transfer of a firearm from one individual to another. Analogues to this form include Form 5, which is used for the transfer of a firearm to the estate of a deceased person.

The completion of this form can have a significant impact on the future of the participants, as any errors or false statements can result in criminal charges. The form is submitted to the ATF and is stored in their database.

In summary, the Form 3 - Application for Tax-Exempt Transfer of Firearm and Registration to Special Occupational Taxpayer (National Firearms Act) (ATF Form 5320.3) is a critical document for licensed firearms dealers. It is important to accurately complete the form to avoid legal issues and to follow the necessary steps to obtain approval.