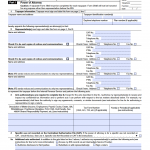

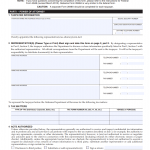

The Tax Power of Attorney is a legal form allowing someone, also known as the "agent" or "attorney-in-fact," to act on behalf of another person, known as the "taxpayer," for specific tax-related matters.

The form consists of several parts, including:

1. Taxpayer Information: This section requires the taxpayer's name, Social Security Number or Employer Identification Number, and mailing address.

2. Representative Information: This section requires the representative's name, address, phone number, and email address.