Tax Power of Attorney

The Tax Power of Attorney is a legal form allowing someone, also known as the "agent" or "attorney-in-fact," to act on behalf of another person, known as the "taxpayer," for specific tax-related matters.

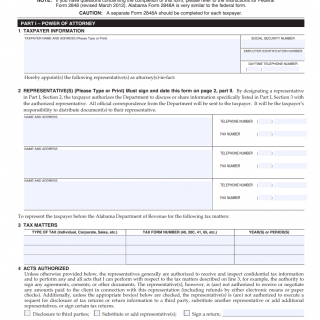

The form consists of several parts, including:

1. Taxpayer Information: This section requires the taxpayer's name, Social Security Number or Employer Identification Number, and mailing address.

2. Representative Information: This section requires the representative's name, address, phone number, and email address.

3. Grant of Authority: This section identifies the specific tax matters that the representative can act upon, including filing tax returns, requesting information from the IRS, and signing documents on behalf of the taxpayer.

4. Signature: This section requires both the taxpayer's and representative's signatures, as well as the date.

The Tax Power of Attorney is drawn up in cases when someone needs to represent another person for tax-related matters. For example, it is commonly used by businesses that need to designate an employee or accountant to handle their taxes, or by individuals who may require assistance filing their taxes due to physical or mental limitations.

The parties involved in completing the Tax Power of Attorney are the taxpayer and the representative. The taxpayer is the person who identifies the tasks they want their representative to handle, while the representative is the person designated to handle those tasks.

When compiling the Tax Power of Attorney form, it is important to specify the specific tasks that the representative can perform. This will ensure that the representative does not exceed the authority granted to them, which could lead to legal and financial consequences. Additionally, both parties should ensure that they sign and date the form correctly, as this will help to validate the document.

One of the advantages of the Tax Power of Attorney is that it allows the taxpayer to delegate their tax-related tasks to someone else, which can relieve stress and ensure that tax obligations are met on time. However, problems can arise if the form is not filled out correctly or if the representative exceeds their authority. In such cases, the taxpayer could be held responsible for any legal or financial consequences resulting from the representative's actions.

In summary, the Tax Power of Attorney is an important legal document that can help taxpayers delegate their tax-related tasks to a representative. It requires careful consideration and should be completed accurately to ensure that everyone involved is protected.