Financial Power of Attorney

A financial power of attorney is a legal document that authorizes someone else, usually called an agent or attorney-in-fact, to act on behalf of another person, called the principal. The purpose of a financial power of attorney is to grant authority to the appointed person to manage the financial and business matters of the principal, including managing bank accounts, investments, and property transactions.

The form typically includes the following parts:

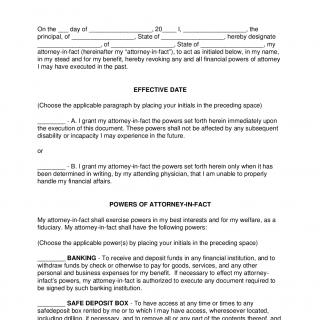

- Identification of the parties: The form identifies the principal who is the person authorizing the power of attorney, and the agent who’s authorized to act on the principal’s behalf.

- Powers granted to the agent: It lists the specific powers that the principal is authorizing the agent to act on his or her behalf. The powers may include the ability to buy, sell or manage property, execute financial transactions, and sign legal documents.

- Duration of the authorization: The form specifies the period for which the principal’s financial power of attorney is valid, and whether it’s a limited or a general power of attorney.

- Conditions or limitations: The form may have restrictions on what the agent can do, or may add certain conditions on their use of the power of attorney.

The Financial Power of Attorney form is typically drawn up when the principal is alive and capable of making their own decisions but wants to appoint an agent to act on their behalf if they become incapacitated. It may also be used by those who may be unable to manage their affairs due to extended travel or other circumstances.

The parties involved in a financial power of attorney include the principal, who appoints an agent, who will act in his/her place in terms of financial decisions. It’s important to ensure that the person being appointed is trustworthy, reliable, and capable of handling the principal’s financial matters.

When compiling a Financial Power of Attorney form, it’s essential to consider a few features. The person who’s given the power of attorney must be explicitly authorized to perform the tasks in question. Additionally, the powers must be narrowly defined, giving the agent the specific powers that they need while limiting their broader authority. The form should also define the circumstances under which the power of attorney is effective, the duration of authority, and any specific termination contingencies, such as the principal’s incapacity or death.

The main advantage of a Financial Power of Attorney is that it can help to delegate authority and manage the principal’s finances even when the principal is unable to do so. On the other hand, if a Power of Attorney form is filled out incorrectly, it could result in the agent misusing or abusing the authority granted to them, committing acts that the principal did not intend, or causing legal and financial issues for the principal or their family members. For this reason, it’s essential to consult with an attorney to ensure that the form is filled out correctly and to have a trusted agent.