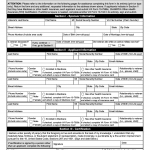

VA Form 10-10d. Application for CHAMPVA Benefits

VA Form 10-10d, Application for CHAMPVA Benefits, is a form used to apply for health care benefits for the spouse or child of a veteran who has been rated permanently and totally disabled for a service-connected disability.

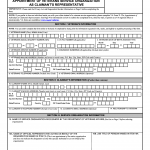

VA Form 21-22. Appointment of Veterans Service Organization as Claimant's Representative

VA Form 21-22, Appointment of Veterans Service Organization as Claimant's Representative, is a form used by veterans to appoint a Veterans Service Organization (VSO) as their representative for VA claims and appeals.

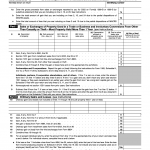

IRS Form 8938. Statement of Specified Foreign Financial Assets

IRS Form 8938, Statement of Specified Foreign Financial Assets, is a tax form used to report specified foreign financial assets and calculate the taxpayer's tax liability. The form is used by U.S.

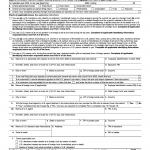

IRS Form 4797. Sales of Business Property

IRS Form 4797, Sales of Business Property, is a tax form used to report the sale of business property and calculate the gain or loss on the sale. The form is used by individuals, partnerships, corporations, and trusts to report the sale of depreciable and non-depreciable business property.

SAR 7 Form. Eligibility status report

The SAR 7 Form, or Semi-Annual Report Form, is a legal document used by the California Department of Social Services to determine eligibility for public assistance programs such as CalWORKs, CalFresh, and Medi-Cal.

DD Form 2870. Authorization for Disclosure of Medical or Dental Information

The DD Form-2870, Authorization for Disclosure of Medical or Dental Information, is a legal document used by the Department of Defense (DoD) to allow the release and disclosure of medical or dental information to specific individuals or entities.

IRS Form 2553. Election by a Small Business Corporation

The IRS Form 2553 is used by small business corporations to elect to be treated as an S corporation for tax purposes.

IRS Form 3520. Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

The IRS Form 3520 is an annual return form that is used to report transactions with foreign trusts and the receipt of certain foreign gifts.

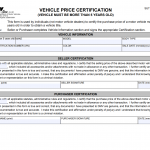

Form SUT 1. Vehicle Price Certification

The Vehicle Price Certification form is a legal document used in Virginia when selling a vehicle that is more than 5 years old. The main purpose of the form is to certify the selling price of the vehicle, which is important for calculating the sales tax that the buyer will need to pay.

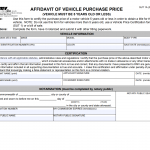

Form SUT 1A. Affidavit of Vehicle Purchase Price

An Affidavit of Vehicle Purchase Price is a legal document used in the state of Virginia to verify the purchase price of a vehicle for tax purposes. The form consists of several sections that require important information from both the buyer and seller of the vehicle.