SF 181. Ethnicity and Race Identification

The SF 181 Ethnicity and Race Identification form is used by federal agencies to collect data on the race and ethnicity of their employees. The main purpose of the form is to promote diversity and equal employment opportunities within the federal workforce.

Acknowledgement Letter

An Acknowledgement Letter is a formal document that is used to confirm receipt of goods, services, or documents. It is an essential communication tool in business and is used to acknowledge the receipt of a product or service, as well as to confirm the terms and conditions of a transaction.

Academic Letter of Recommendation

An Academic Letter of Recommendation is a form used to provide a recommendation for a student or graduate school applicant. The main purpose of this form is to provide an assessment of the applicant's academic abilities, character, and potential for success.

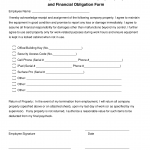

Acknowledgement of Receipt of Company Property

Acknowledgement of Receipt of Company Property is used to acknowledge the receipt and assignment of company property by an employee.

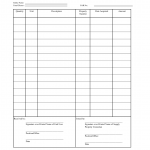

Property Acknowledgment Receipt

A Property Acknowledgment Receipt (PAR) is a legal document that serves as evidence of the transfer of ownership or possession of a property. It consists of several parts, including a header with the PAR number, the date of issuance, and the names of the parties involved in the transaction.

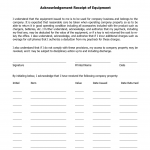

Acknowledgement Receipt of Equipment

An Acknowledgement Receipt of Equipment is a form that is used to confirm the receipt of equipment from one party to another. It is a legally binding document that is used to ensure that all parties involved are aware of the equipment that has been received and that it is in good condition.

Acknowledgement Receipt of Documents

Acknowledgement Receipt of Documents is a form that serves as proof of receipt of documents by a recipient. The main purpose of this form is to confirm that the documents have been received by the intended party and to provide a record of the transaction.

Acknowledgement Receipt of Payment

An Acknowledgement Receipt of Payment is a document that serves as proof of payment received by a seller or service provider from a buyer or customer.

Acknowledgement for Dissertation

An acknowledgement section in a dissertation is a part of the document where the author expresses gratitude and appreciation towards the individuals and organizations who have contributed to the completion of the research.

Acknowledgement for Group Assignment

An acknowledgement section in a group assignment is a part of the report or project where the group members acknowledge the individuals and organizations who have contributed to the completion of the assignment.