SBA Form 1920. Lender's Application for Guaranty

SBA Form 1920, also known as the Lender's Application for Guaranty, is a document required by the U.S. Small Business Administration (SBA) for lenders seeking to obtain a guaranty for a loan made to a small business under the SBA loan program. The main purpose of the form is to provide information about the lender and the loan to the SBA, and to request a guaranty for the loan.

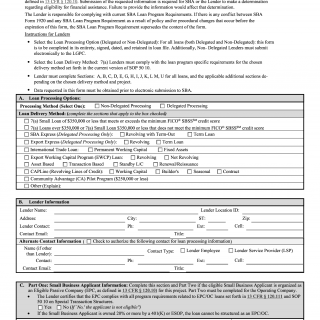

The form consists of several parts, including lender information, borrower information, loan information, and collateral information. Important fields include lender name, borrower name, loan amount, loan purpose, collateral value, and loan term. The parties involved in the form are the lender, the borrower, and the SBA.

When filling out the form, it is important to provide accurate and complete information to ensure that the loan is eligible for an SBA guaranty. Applicants will need to provide information about their lending institution, the borrower and their business, the loan amount and purpose, and collateral value.

Examples of application and use cases for the form include lenders seeking to provide SBA 7(a) loans, SBA 504 loans, and disaster loans to small businesses. Strengths of the form include its ability to provide a guarantee for the loan, which can reduce risk for the lender and make it easier for the borrower to obtain financing. Weaknesses of the form include the potential for delays or denial of the guaranty if the loan application is incomplete or inaccurate.

Alternative forms include SBA Form 159, the Fee Disclosure and Compensation Agreement, and SBA Form 2237, the CDC Application for 504 Loan Guaranty. Differences between these forms include the specific information requested and the purpose of the form.

The form can affect the future of the participants by providing access to financing for their business, which can help with growth and stability. The form is submitted to the SBA through an SBA-approved lender, and is stored securely by the lender and the SBA.

In summary, SBA Form 1920 is a required document for lenders seeking to obtain a guaranty for a loan made to a small business under the SBA loan program. It collects important information about the lender, borrower, loan, and collateral, and is used to request an SBA guaranty for the loan. Accurate and complete information is important when filling out the form, and alternative forms are available for specific purposes. The form can provide access to financing and affect the future of the participants. The form is submitted to the SBA through an SBA-approved lender and is stored securely by the lender and the SBA.