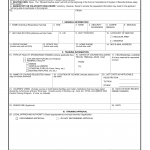

DA Form 3758-R. Calibration and Repair Requirements Worksheet (LRA)

Form DA 3758-R is used by the United States Army to document calibration and repair requirements for equipment or systems. This form is specifically designed for use in Logistics Readiness Activities (LRAs) to track and plan maintenance actions related to calibration and repair.

DA Form 3761. Public Health Nursing Activities Report

The DA Form 3761, also known as the Public Health Nursing Activities Report, is a form used by public health nurses to document and report their activities.

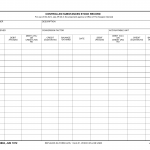

DA Form 3780. Pallet Count

The DA Form 3780, known as the Pallet Count form, is used to record and document the count of pallets in a specific location or area. This form is commonly utilized in logistics and supply chain management to maintain accurate records of pallet inventory.

DA Form 3787-R. Depot Report of Location Survey (LRA)

The DA Form 3787-R, also known as the Depot Report of Location Survey (LRA), is a form used to conduct a location survey at a depot or military installation. This form is typically utilized by personnel responsible for managing and maintaining military equipment and assets.

DA Form 3824. Urologic Examination

The DA Form 3824, also known as the Urologic Examination form, is used to document and record the results of a urologic examination.

DA Form 3830. Nonappropriated Fund Bank Balances

The DA Form 3830, known as the Nonappropriated Fund Bank Balances form, is used to record and track the bank balances of nonappropriated funds (NAF).

DA Form 3838. Application for Short Course Training

The DA Form 3838, also known as the Application for Short Course Training form, is used to apply for short-term training programs or courses within the military.

DA Form 3857. Commercial Deliveries of Bulk Petroleum Products Checklist

The DA Form 3857, also known as the Commercial Deliveries of Bulk Petroleum Products Checklist, is used to document and verify the delivery of bulk petroleum products from commercial suppliers.

DA Form 3862. Controlled Substances Stock Record

The DA Form 3862, known as the Controlled Substances Stock Record, is used to track and document the inventory of controlled substances within a medical or healthcare facility.

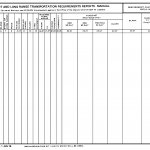

DA Form 3865-R. Short- And Long-Range Transportation Requirements Report - Manual (LRA) (Jun 73 Ed Will Be Used Til Exhausted)

The DA Form 3865-R, also known as the Short- and Long-Range Requirements Report - Manual (LRA), is used to document and report requirements for military operations.