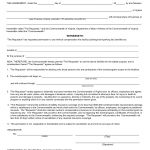

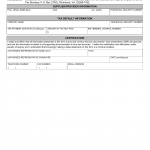

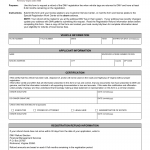

Form FMS 210. Vehicle Registration Refund, Application for - Virginia

Form FMS 210. Vehicle Registration Refund, Application for is used by vehicle owners in Virginia to request a refund of the DMV registration fee when vehicle tags are returned to DMV before expiration and with at least 6 months remaining on the registration.

The parties involved in this form are the vehicle owner requesting the refund and the Virginia Department of Motor Vehicles (DMV). The form sections consist of fields where the vehicle owner provides personal information, vehicle details, and reasons for requesting the refund.