Form FT 214. Virginia Fuels Tax Notice of Tax Payment Default - Virginia

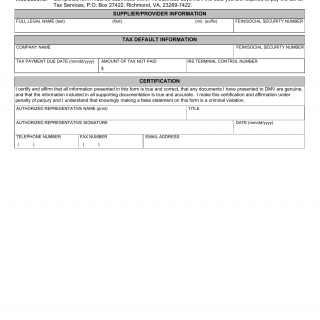

Form FT 214. Virginia Fuels Tax Notice of Tax Payment Default is used by licensed suppliers or providers of alternative fuel to report tax payment default to the Virginia Department of Motor Vehicles (DMV). The primary purpose of this form is to inform the DMV of any failure to pay the required fuels tax on time.

The parties involved in this form are the licensed fuel suppliers or providers and the Virginia Department of Motor Vehicles (DMV). The form consists of sections where the supplier provides information about the fuel sales and any tax payment default.

Important fields in this form include the supplier's name, contact information, details of the fuel sales, and the amount of fuel tax owed. The form may also require an explanation of the reason for the payment default.

An example scenario where this form would be used is when a licensed fuel supplier inadvertently misses the deadline for paying the fuels tax. By using this form, the supplier can promptly report the default to the DMV and make arrangements to rectify the situation.

When completing this form, the supplier should ensure accuracy in reporting the fuel sales and the tax owed. It is crucial to address the payment default promptly to avoid penalties or sanctions.

No specific additional documents are mentioned for this form. Related forms could include other fuel tax reporting forms required by the DMV. An alternative could be using electronic systems for tax reporting and payments instead of submitting paper forms.