Promotion Recommendation Letter

A Promotion Recommendation Letter is a document that supports an employee's promotion to a higher position within an organization. It is an important tool in the promotion process, as it provides evidence of the employee's skills, achievements, and potential for success in a new role.

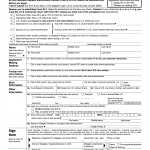

IRS Form W-7. Application for IRS Individual Taxpayer Identification Number

The Form W-7 is an official application for an Individual Taxpayer Identification Number (ITIN) issued by the Internal Revenue Service (IRS) of the United States.

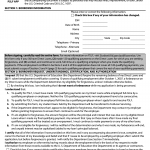

Public Service Loan Forgiveness (PSLF): Application for Forgiveness

The Public Service Loan Forgiveness (PSLF) Application for Forgiveness is a form used by individuals who have made qualifying payments on their federal student loans while working full-time for a qualifying public service employer.

Letters of Intent

A letter of intent is a document that outlines an agreement between two or more parties before a formal contract is drawn up. It can also be a tool used to express interest in a certain opportunity, such as a job or university program.

Employment Verification Letter

An employment verification letter is a document that confirms an individual's employment status and details. It is typically requested by an external party, such as a lender or landlord, to verify a person's income and employment history.

Verification of Non-Filing Letter

A Verification of Non-Filing Letter is a document issued by the Internal Revenue Service (IRS) to confirm that an individual or entity did not file a tax return for a specific tax year.

Debt Validation Letter

A debt validation letter is a written request sent by a debtor to a creditor or collection agency asking for proof of the validity of a debt.

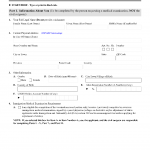

Form I-693. Report of Immigration Medical Examination and Vaccination Record

The I-693, Report of Immigration Medical Examination and Vaccination Record is a form that is required by the United States Citizenship and Immigration Services (USCIS) for applicants seeking adjustment of status to permanent residence.

Papers for Divorce

Filing for divorce is a complex process that requires the submission of multiple forms and documents. Each state has its own unique set of forms that must be filed in order to complete the procedure. In this article, we will provide a list of the 20 most popular forms for a divorce procedure.

Letter of Interest

A letter of interest is a type of cover letter that is sent to a company or organization to express interest in a job or internship opportunity. It is a way to introduce yourself and highlight your skills and qualifications in a way that makes you stand out from other applicants.