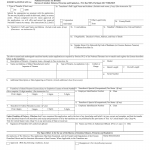

ATF Form 4. Application for Tax Paid Transfer and Registration of Firearm (ATF Form 5320.4)

ATF Form 4 - Application for Tax Paid Transfer and Registration of Firearm (ATF Form 5320.4) is a legal document used to transfer ownership of a firearm that is regulated under the National Firearms Act (NFA).

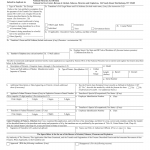

ATF Form 5. Application for Tax Exempt Transfer and Registration of Firearm (ATF Form 5320.5)

ATF Form 5 - Application for Tax Exempt Transfer and Registration of Firearm (ATF Form 5320.5) is a legal document used to transfer ownership of a firearm that is regulated under the National Firearms Act (NFA) without paying a transfer tax.

Landlord Reference Letter

A landlord reference letter is a document that verifies a tenant's rental history and provides a recommendation to future landlords.

Meeting Forms and Templates

Meetings are an integral part of any organization, whether it's a startup, a small business, or a multinational corporation. The success of a meeting depends on various factors, including an agenda, minutes, and action items.

Self-Presentation forms

Self-presentation is a crucial aspect of today's society, be it for personal or professional purposes.

Character Letters

A character letter is a type of letter used to describe someone's personality, skills, and attributes. It can be used for various purposes such as job applications, college admissions, or as evidence in court.

How to write a termination letter

Be determined! State exactly what you mean in your termination letter. Don’t mince your words and speak directly. Do not waste the time of a person who is being discharged by writing big references for him before you get down to business.

End of Employment Letter

An end of employment letter, sometimes referred to as a termination letter, formally notifies an employee that their employment with the company is ending. It is typically issued by the employer and covers various situations, such as layoffs, resignations, or the conclusion of a project.

Form VAF1A. Application for UK visa to visit or for short-term stay

Form VAF1A is an application form used for individuals who wish to visit or transit through the United Kingdom for short-term stays.

Employment Termination Letters

Termination of employment is a difficult and sensitive process for both employers and employees. There are various reasons for termination, such as layoffs, firing, job abandonment, and dismissal, and each requires a different type of letter to be issued to the employee.