Form HSMV 82993. Separate Odometer Disclosure Statement and Acknowledgment

The HSMV 82993 form is used in Florida as a separate Odometer Disclosure Statement and Acknowledgment for the sale of a vehicle. The main purpose of this form is to provide a clear and official statement of the vehicle's odometer reading at the time of sale.

Form HSMV 82139. Application for Notice of Lien / Reassignment of Lien or Notice to First Lienholder of Subsequent Lien

The HSMV 82139 form is used in Florida to apply for a Notice of Lien, Reassignment of Lien, or Notice to First Lienholder of Subsequent Lien. The main purpose of this form is to provide notice to lienholders of any changes in the lien status of a vehicle.

Form HSMV 82042. Vehicle Identification Number and Odometer Verification

The HSMV 82042 form is used to verify the Vehicle Identification Number (VIN) and odometer reading of a vehicle in Florida. The main purpose of this form is to ensure that the vehicle's identification number and odometer reading are accurate and have not been tampered with.

Form HSMV 82101. Application for Duplicate or Lost in Transit/Reassignment for a Motor Vehicle, Mobile Home or Vessel Title Certificate

The HSMV 82101 form is an application for a duplicate or lost in transit/reassignment for a motor vehicle, mobile home, or vessel title certificate in Florida.

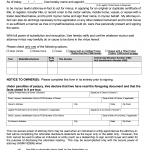

Form HSMV 82053. Power of Attorney For a Motor Vehicle, Mobile Home, Vessel or Vessel with Trailer

The HSMV 82053 form is a power of attorney document used in Florida for a motor vehicle, mobile home, vessel, or vessel with a trailer. The form is used when a vehicle owner needs to appoint an agent to act on their behalf for certain transactions related to their vehicle.

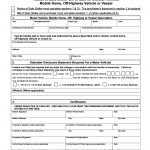

Form HSMV 82040. Application for Certificate of Title With/Without Registration

The HSMV 82040 form is used to apply for a certificate of title for a vehicle in Florida. The form is used to transfer the ownership of a vehicle, request a duplicate title, or add or remove a lien from a title.

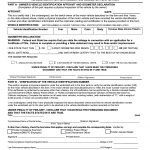

Form HSMV 82050. Notice of Sale and/or Bill of Sale for a Motor Vehicle, Mobile Home, Off-Highway Vehicle or Vessel (FL)

The Form HSMV 82050, Notice of Sale and/or Bill of Sale for a Motor Vehicle, Mobile Home, Off-Highway Vehicle, or Vessel is a legal document used in the State of Florida to establish proof of the transfer of ownership of a vehicle, mobile home, off-highway vehicle, or vessel.

SF 180. Request Pertaining to Military Records

The SF 180 Request Pertaining to Military Records is a form used by veterans, their families, and authorized representatives to request information from military service records.

SF 98. Notice of Intention to Make a Service Contract and Response to Notice

The SF 98 Notice of Intention to Make a Service Contract and Response to Notice is a form used by government agencies to notify potential contractors of their intention to award a service contract and to receive a response from interested parties.

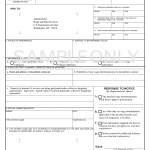

IRS Form 5498. IRA Contribution Information

Form 5498 is an IRS tax form that reports contributions made to individual retirement arrangements (IRAs), including traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs.