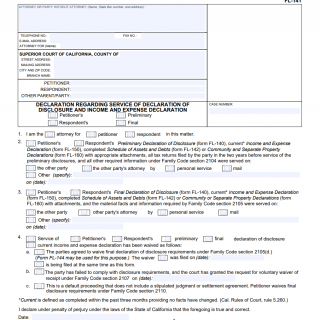

Form FL-141 Declaration of Disclosure

FL-141 Declaration of Disclosure is a form used in California family law cases. It is also known as the Property Declaration form. The purpose of the form is to provide a detailed list of all the assets and debts that each party has, including separate and community property. This is an important document for the court to determine how to divide the property and debts during the divorce process.

The form consists of two pages, each with several sections that need to be filled out. The first page includes sections for personal information, separate property assets, and community property assets. The second page includes sections for debts and other liabilities, and a declaration and signature section.

Some important fields that need to be filled out include the name, address, and phone number of both parties, the date of marriage, the date of separation, and a list of all the assets and debts. The form also requires the parties to specify whether an asset is separate or community property.

Examples of use include filling out the form during divorce proceedings, legal separation, or annulment. The parties involved are usually the two spouses getting a divorce. It is important to consider all assets and debts when compiling the form, including those that may be hidden or unknown. This is important because the court will use this information to make decisions about property division, spousal support, and child support.

The benefits of filling out the FL-141 form include providing the court with a complete and detailed list of assets and debts, which can help to ensure a fair and equitable distribution of property. It can also help to speed up the divorce process by providing all the necessary information upfront.

Some potential problems and risks include incomplete or inaccurate information, which can result in an unfair distribution of property. It is important to be truthful and complete when filling out the form. If the form is not filled out correctly, it can result in legal consequences and delays in the divorce process.

Related and alternative forms include the FL-142 form, which is used for the same purpose but is more detailed and includes a section for income and expenses. Analogues to this form may vary by state or country, but most jurisdictions have similar forms for property declaration during divorce proceedings.

The main difference between FL-141 and other property declaration forms is the level of detail required. FL-141 is a basic form that lists all assets and debts, while other forms may include more detailed information such as income and expenses.

The FL-141 form is an important document that will influence the future of the participants because it will determine how property and debts are divided during the divorce process. It is important to fill out the form accurately and completely to ensure a fair and equitable distribution of property.

The completed FL-141 form should be submitted to the court and a copy should be kept for personal records. It is important to store the form in a safe place, as it contains sensitive financial information.