Medical Appeal Letter

A medical appeal letter is a formal document that is used to appeal a decision made by a health insurance provider that denies coverage for a medical procedure, treatment or medication.

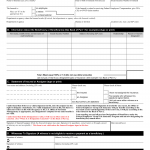

SF 2818. Continuation of Life Insurance Coverage as an Annuitant or Compensationer

SF 2818 is a form used by annuitants or compensationers to continue their life insurance coverage after retirement. Its purpose is to allow individuals to maintain coverage for themselves and their eligible family members at the same level as before retirement.

SF 3107. Application for Immediate Retirement (Federal Employees Retirement System)

SF 3107 is an official form used for applying for immediate retirement under the Federal Employees Retirement System (FERS). The form consists of five parts, some of which require detailed information about the applicant's work history, dependents, and financial information.

SF 3102. Designation of Beneficiary (Federal Employees Retirement System)

Form SF 3102 is a Designation of Beneficiary form for the Federal Employees Retirement System (FERS). The purpose of this form is to allow federal employees to designate who will receive their retirement benefits in the event of their death.

SF 2823. Designation of Beneficiary (Federal Employees' Group Life Insurance)

Form SF 2823 is a Designation of Beneficiary form for Federal Employees' Group Life Insurance (FEGLI). The purpose of this form is to allow federal employees to designate who will receive the life insurance benefits in the event of their death.

Traffic Violation Appeal Letter

A traffic violation appeal letter is a document that is written to contest a traffic ticket or citation that has been issued by law enforcement.

SF 85. Questionnaire for Non-Sensitive Positions

The SF-85 is a form used by individuals seeking employment in non-sensitive positions within the federal government.

SF 15. Application for 10-Point Veteran Preference

The SF-15 is a form used by veterans to apply for 10-point preference when applying for federal jobs.

Appreciation Letter to Employee

Appreciation Letter to Employee is a document used to recognize and appreciate the outstanding performance or dedication of an employee. It is not a mandatory document, but it is a good practice to send one as it shows your appreciation for the employee's hard work and dedication.

Immigration Appeal Letter

An Immigration Appeal Letter is a document used to appeal a decision made by an immigration authority regarding visa or citizenship status. The purpose of the form is to request a review of the decision and to provide additional information or evidence that may affect the outcome of the case.