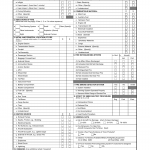

DA Form 2397-12. Technical Report of U.S. Army Aircraft Accident Part Xiii - Fire

The DA Form 2397-12 is a part of the technical report for U.S. Army aircraft accidents and focuses specifically on fire-related aspects of the accident.

DA Form 2397-13. Technical Report of U.S. Army Aircraft Accident Index A

The DA Form 2397-13 is used as an index for the technical report of U.S. Army aircraft accidents. This form provides a summary of the accident investigation and serves as a reference point for locating specific sections or parts within the complete report.

DA Form 2397-14. Technical Report of U.S. Army Aircraft Accident Index B

The DA Form 2397-14 is used as an index for the technical report of U.S. Army aircraft accidents. This form provides a summary of the accident investigation and serves as a reference point for locating specific sections or parts within the complete report.

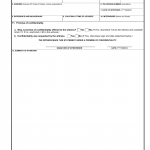

DA Form 2397-2. Technical Report of Us Army Aircraft Accident Part Iii - Findings and Recommendations

The DA Form 2397-2 is a part of the technical report for U.S. Army aircraft accidents and focuses specifically on documenting the findings and recommendations resulting from the accident investigation.

DA Form 2397-3. Technical Report of U.S. Army Aircraft Accident Part Iv - Narrative

The DA Form 2397-3 is a part of the technical report for U.S. Army aircraft accidents and focuses on providing a detailed narrative of the accident sequence and related events.

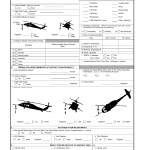

DA Form 2397-4. Technical Report of U.S. Army Aircraft Accident Part v - Summary of Witness Interview

The DA Form 2397-4 is a part of the technical report for U.S. Army aircraft accidents and focuses on summarizing witness interviews conducted during the accident investigation.

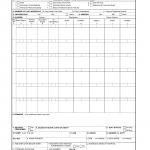

DA Form 2397-5. Technical Report of U.S. Army Aircraft Accident Part Vi - Wreckage Distribution

The DA Form 2397-5 is a part of the technical report for U.S. Army aircraft accidents and focuses on documenting the distribution and location of wreckage resulting from the accident. This form is used to record the positions and conditions of various aircraft components and debris.

DA Form 2397-6. Technical Report of U.S. Army Aircraft Accident Part Vii - In-Flight or Terrain Impact and Crash Damage Data

The DA Form 2397-6 is a part of the technical report for U.S. Army aircraft accidents and focuses on documenting data related to in-flight or terrain impact and crash damage resulting from the accident.

DA Form 2397-7. Technical Report of U.S. Army Aircraft Accident Part Viii - Maintenance and Material Data

The DA Form 2397-7 is used to document the maintenance and material data related to U.S. Army aircraft accidents. This form is a part of the technical report that provides crucial information about the accident, specifically focusing on the maintenance and material aspects.

DA Form 2397-9. Technical Report of U.S. Army Aircraft Accident Part X - Injury/Occupational Illness Data

The DA Form 2397-9 is used to record injury and occupational illness data related to U.S. Army aircraft accidents. It is a part of the technical report that focuses on capturing information about injuries or illnesses sustained by personnel involved in the accident.