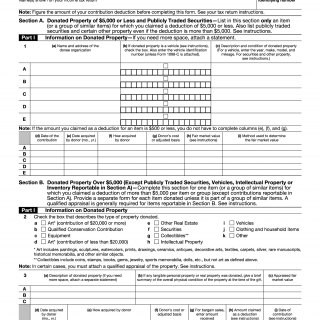

IRS Form 8283. Noncash Charitable Contributions

Form 8283, officially known as "Noncash Charitable Contributions", is used by taxpayers to substantiate and report their noncash donations to qualified charities and organizations. It is a tax form issued by the Internal Revenue Service (IRS) and requires the taxpayer's name, taxpayer ID, signature, and the date. Additionally, the taxpayer must also enter the donor’s name, address, and email address.

Form 8283 is divided into four sections. Part I records a description of the donated items, such as a car, boat, or other noncash items. This includes the type and condition of the item, as well as the appraised value of the item and the date it was donated. Part II requires the donor to certify the appraised value of the item with a signature of an independent appraiser. Part III is for complex donations that are worth more than $5,000. This section requires the donor to provide a summary of the applicable information and attach an additional form, Form 8282. Finally, Part IV is for donations of partial interests in property such as a partnership interest or fractional share of stock.

The strengths of Form 8283 include its comprehensive coverage of the informational requirements needed to provide evidence of noncash donations. The form covers all types of items, including cars, boats, property, and other noncash items. Furthermore, the form requires a signature of an independent appraiser as well as an additional form, Form 8282, if the donation is worth more than $5,000.

The weaknesses of Form 8283 are that it may require additional documentation and paperwork. For example, in Part III, the donor must attach a Form 8282 with a summary of the applicable information, and in Part IV, the donor must provide a statement from the donee including a description of the property. Additionally, there may be inconsistencies in reporting values, and the IRS may challenge or reject values that it deems to be unrealistic or inaccurate.

Form 8283 is an important form for individuals and corporations who are making noncash charity contributions. It is submitted to the IRS when filing taxes and affects the future of the donor and donee as they may receive tax credits for donations. It is important to ensure that the form is filled out accurately and that all additional documentation is included in order to satisfy the requirements of the form.