VA Form 26-1820. Report and Certification of Loan Disbursement

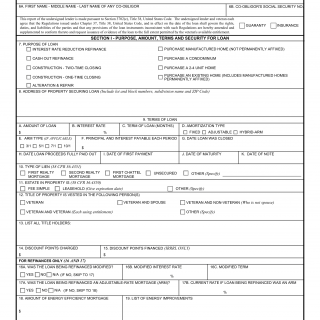

The VA Form 26-1820, titled "Report and Certification of Loan Disbursement," is a crucial document provided by the Department of Veterans Affairs (VA) to certify the disbursement of a loan for a designated purpose. This form is used in the context of VA-guaranteed loans, specifically the VA Home Loan Program, which aims to help veterans, active-duty service members, and eligible surviving spouses obtain affordable housing.

The main purpose of this form is to ensure that the loan proceeds are used for the intended purpose, such as the purchase, construction, or improvement of a home, and to certify that the disbursement of funds aligns with the terms and conditions of the loan agreement.

The form consists of several sections that require both the lender and the borrower to provide essential information. The lender will fill in details such as the loan identification number, the amount of the loan disbursement, and the recipient's account information to ensure accurate and secure transfer of funds. The borrower will certify the intended use of the funds and provide information about the property, including its address and legal description.

When filling out the form, borrowers will need to provide their personal information, including name, contact details, and social security number, along with details about their loan and the property involved. It is crucial to accurately report the loan disbursement information and clearly state the purpose for which the funds will be used.

Additionally, borrowers may need to attach supporting documents, such as invoices, receipts, or contracts, that demonstrate the legitimate use of the loan proceeds. These documents serve as evidence to support the certification of loan disbursement.

An example application for this form could be a veteran who has been approved for a VA-guaranteed loan to purchase a home. After the loan is approved, the lender will disburse the funds to the borrower, and both the lender and the borrower will complete and sign the VA Form 26-1820. This form ensures that the loan proceeds are used appropriately for the intended purpose of buying the home, and it provides a clear record of the disbursement.

Strengths of this form include establishing transparency and accountability in the loan disbursement process, which helps safeguard the interests of both lenders and borrowers. It ensures that funds are used as intended and reduces the potential for misuse or fraud.

Weaknesses may include the potential complexity of the loan disbursement process, particularly for borrowers who may not be familiar with the paperwork involved. Opportunities for improvement could include providing additional guidance or resources to borrowers to help them navigate the form and understand their rights and responsibilities.

A related form to the VA Form 26-1820 is the VA Form 26-1880, Request for a Certificate of Eligibility, which is used to verify an individual's eligibility for VA home loan benefits. Although these forms have different purposes, they are both part of the overall process of utilizing VA-guaranteed loans.

Successfully completing and submitting this form is crucial for the future of the participants as it ensures the proper use of loan proceeds and validates the borrower's compliance with the loan terms. By accurately reporting the loan disbursement and providing necessary documentation, borrowers protect their eligibility for future VA loan benefits and establish a positive financial track record.

The completed form is typically submitted to the lender or loan servicer for review and certification. Once approved and signed by both the lender and the borrower, a copy of the form is retained by all parties involved. Additionally, the completed form may be stored electronically in the VA's systems or in the lender's records for future reference and audit purposes.