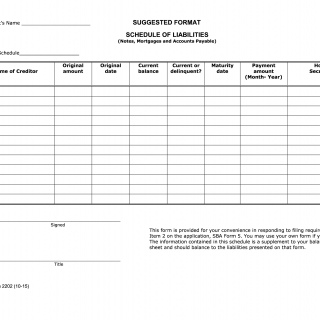

SBA Form 2202. Schedule of Liabilities

SBA Form 2202, also known as Schedule of Liabilities, is a document required by the U.S. Small Business Administration (SBA) for businesses seeking financial assistance through the SBA loan program. The purpose of the form is to provide a detailed list of the borrower's current liabilities, including the name of the creditor, the type of debt, the amount owed, and the payment terms.

The form consists of several parts, including a summary of liabilities, a list of secured creditors, a list of unsecured creditors, and a list of other liabilities. Important fields to consider when filling out the form include the name and address of the creditor, the type of debt, the amount owed, the payment terms, and the collateral securing the debt. The parties involved in the form are the borrower and the SBA.

When filling out the form, data such as the borrower's outstanding debts and payment terms will be required. Additionally, the borrower may need to attach copies of relevant documents, such as loan agreements or credit card statements, to provide supporting documentation for the liabilities listed.

Application examples and use cases for the Schedule of Liabilities form include businesses applying for SBA loans, as well as businesses seeking to refinance or restructure their existing debts. The form can also be used by lenders to assess the borrower's financial health and ability to repay the loan.

Strengths of the form include its ability to provide a clear and detailed picture of the borrower's liabilities, which can help lenders make informed lending decisions. Weaknesses of the form include the potential for errors or omissions in the information provided, as well as the time and effort required to gather and organize the necessary data.

Alternative forms to the Schedule of Liabilities form include the Personal Financial Statement form and the Business Debt Schedule form. Analogues to the form include the Statement of Affairs form used in the United Kingdom and the Balance Sheet form used in Australia.

The Schedule of Liabilities form can have a significant impact on the future of the participants, as it can affect the borrower's ability to obtain financing and manage their debts. It is important to carefully review and accurately complete the form to avoid potential complications or delays in the loan application process.

The form can be submitted online through the SBA's loan application portal, or in person at an SBA district office. Once submitted, the form will be stored in the borrower's loan file and used by the lender to assess the borrower's creditworthiness and ability to repay the loan.