SBA Form 1919. Borrower Information Form

SBA Form 1919, also known as the Borrower Information Form, is a document required by the U.S. Small Business Administration (SBA) for businesses seeking financial assistance through the SBA loan program. The main purpose of the form is to collect information about the borrower and their business to determine eligibility for SBA loans.

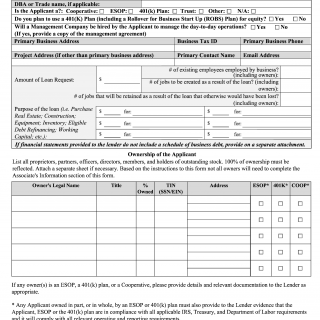

The form consists of several parts, including borrower information, business information, ownership information, and loan information. Important fields include legal name, social security number, business name, tax identification number, business type, ownership percentage, loan amount, and loan purpose. The parties involved in the form are the borrower and the SBA.

When filling out the form, it is important to provide accurate and complete information to avoid delays and potential denial of the loan application. Applicants will need to provide personal and business information, as well as financial statements and tax returns.

Examples of application and use cases for the form include applying for SBA 7(a) loans, SBA 504 loans, and disaster loans. Strengths of the form include its simplicity and ability to streamline the loan application process. Weaknesses of the form include the potential for errors and omissions, which could result in delays or denial of the loan application.

Alternative forms include SBA Form 912, the Statement of Personal History, and SBA Form 413, the Personal Financial Statement. Differences between these forms include the specific information requested and the purpose of the form.

The form affects the future of the participants by providing access to financial assistance for their business, which can help with growth and stability. The form is submitted to the SBA through an SBA-approved lender, and is stored securely by the lender and the SBA.

In summary, SBA Form 1919 is a required document for businesses seeking financial assistance through the SBA loan program. It collects important information about the borrower and their business, and is used to determine eligibility for SBA loans. Accurate and complete information is important when filling out the form, and alternative forms are available for specific purposes. The form can provide access to financial assistance and affect the future of the participants.