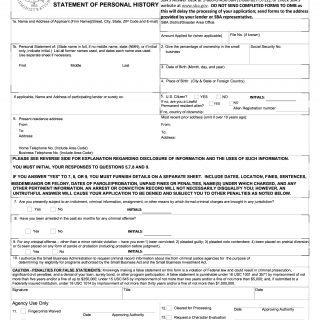

SBA Form 912. Statement of Personal History

SBA Form 912 - Statement of Personal History

SBA Form 912 - Statement of Personal History is a form used by the U.S. Small Business Administration (SBA) to evaluate the personal character and fitness of individuals who apply for certain loans, including the 7(a) loan program, disaster loans, and microloans. The main purpose of the form is to ensure that the applicant has a good reputation and is not involved in any criminal or unethical activities.

The form consists of several parts, including the applicant information section, the personal history section, and the certification section. The applicant information section includes details such as the applicant's name, address, and social security number. The personal history section includes questions about the applicant's personal history, including criminal convictions, civil judgments, and bankruptcies. The certification section requires the applicant to certify that all information provided on the form is true and complete.

Important fields on the form include the applicant's name, address, and social security number, as well as questions related to criminal history, civil judgments, and bankruptcies. It is important to fill out the form accurately and truthfully, as any false statements or omissions may result in the denial of the loan.

The parties involved in the form include the SBA and the loan applicant.

When compiling the form, the data required includes information about the applicant's personal history, including criminal convictions, civil judgments, and bankruptcies. Additional documents that must be attached include a copy of the applicant's driver's license or other government-issued identification, as well as any court documents related to criminal or civil proceedings.

Application examples and use cases for SBA Form 912 include situations where an individual applies for an SBA loan and must provide information about their personal history. This form is particularly useful for the SBA to evaluate the character and fitness of loan applicants.

Strengths of the form include its ability to ensure that loan applicants have a good reputation and are not involved in criminal or unethical activities, while weaknesses include the potential for errors or omissions. Opportunities for the form include the ability to prevent fraud and ensure that loan funds are used appropriately, while threats include potential legal challenges to the form's questions.

Related forms include SBA Form 1919 - Borrower Information Form and SBA Form 159 - Compensation Agreement, which are also used in the SBA loan application process. The main difference between these forms is that SBA Form 912 focuses on the applicant's personal history, while the other forms focus on other aspects of the loan application process.

The form affects the future of the participants by ensuring that loan funds are provided to individuals with good reputations and who are not involved in criminal or unethical activities.

The form is typically submitted as part of the SBA loan application process and is stored in the SBA's database for record-keeping purposes.