SBA Form 159. Fee Disclosure and Compensation Agreement

SBA Form 159 is a Fee Disclosure and Compensation Agreement form that is used by Small Business Administration (SBA) lenders and loan applicants. The purpose of this form is to disclose all the fees and compensation that the lender will receive in connection with the loan, and to ensure transparency in the lending process.

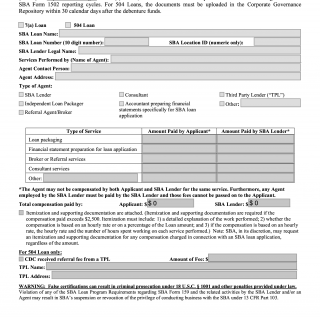

The form consists of four parts:

- Applicant Information - This section requires the applicant to provide their personal and business details, including their name, address, and loan amount.

- Lender Information - This section requires the lender to provide their name, address, and compensation details, including the amount and type of fees they will receive.

- Certification - This section requires both the applicant and the lender to sign and certify that all the information provided in the form is accurate and complete.

- Acknowledgment - This section acknowledges that the borrower has received a copy of the form.

Important fields to consider when compiling the form include the loan amount, the type and amount of fees charged by the lender, and the borrower's personal and business information. The form must be accompanied by other loan documents, such as the loan application and credit report.

Examples of application and use cases include SBA-guaranteed loans, small business loans, and disaster loans. The form is necessary to ensure transparency in the lending process and to protect borrowers from hidden fees and charges.

Strengths of the form include its ability to provide transparency in the lending process and protect borrowers from hidden fees and charges. Weaknesses include the potential for confusion and misunderstanding of the fees and compensation disclosed in the form.

There are no known alternative forms or analogues to SBA Form 159. However, other SBA loan forms, such as SBA Form 1919, may be required for loan applications.

The form affects the future of the participants by ensuring transparency in the lending process and protecting borrowers from hidden fees and charges. The form is submitted to the lender and stored in the loan file.

In conclusion, SBA Form 159 is an important form that ensures transparency in the lending process and protects borrowers from hidden fees and charges. It is necessary for SBA-guaranteed loans, small business loans, and disaster loans, and requires the borrower and lender to disclose all fees and compensation.