SBA Form 413 Personal Financial Statement

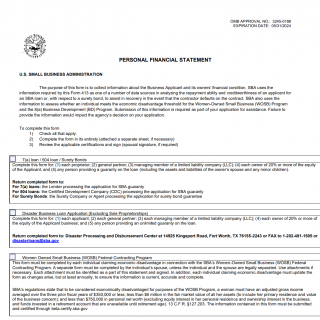

SBA Form 413, also known as the Personal Financial Statement, is a legal document used by the U.S. Small Business Administration (SBA) to assess the financial health of an individual applying for a loan. The form is divided into two parts, with Part 1 collecting personal information, including the borrower's name, address, and Social Security number, and Part 2 collecting financial information, including assets, liabilities, income, and expenses.

Some of the important fields on the form include total assets, total liabilities, net worth, and income from all sources. SBA Form 413 is commonly used by small business owners and other individuals applying for SBA loans. It's also used by lenders to evaluate the financial standing of potential borrowers.

It's important to be thorough and accurate when compiling the information for the form. Borrowers should gather all relevant financial documents and take the time to review and double-check the information before submitting the form. Inaccurate or incomplete information may result in the borrower being denied a loan or facing other financial consequences.

SBA Form 413 can help borrowers secure loans and other forms of financial assistance by demonstrating their financial standing and ability to repay the loan. However, if the borrower fails to repay the loan, it may negatively impact their credit score and future financial opportunities.

Other related forms include SBA Form 912 Statement of Personal History and SBA Form 1919 Borrower Information Form. Other organizations, such as banks and credit unions, may have their own personal financial statements with similar information requirements. SBA Form 413 is specifically designed for SBA loan applications and has unique requirements and fields that may differ from other personal financial statements.

Completed forms are typically submitted to the lender or SBA for review. The form may be stored electronically or in paper format depending on the lender's record-keeping practices. Overall, SBA Form 413 provides a comprehensive overview of the borrower's financial status and can have a significant impact on their future financial standing and ability to secure loans or other forms of financial assistance.