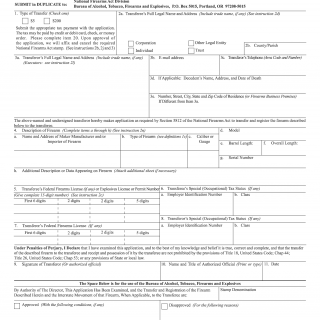

ATF Form 4. Application for Tax Paid Transfer and Registration of Firearm (ATF Form 5320.4)

ATF Form 4 - Application for Tax Paid Transfer and Registration of Firearm (ATF Form 5320.4) is a legal document used to transfer ownership of a firearm that is regulated under the National Firearms Act (NFA). The form is used to register a firearm and pay taxes associated with the transfer of ownership.

The main purpose of Form 4 is to ensure that the transfer of a firearm is legal and that all taxes associated with the transfer have been paid. The form consists of several parts, including the applicant's personal information, information about the firearm being transferred, and the signature of the applicant and the transferor.

Important fields in Form 4 include the applicant's full name, address, and social security number, as well as information about the firearm being transferred, such as the make, model, and serial number.

When compiling or filling the form, applicants will need to provide detailed information about the firearm being transferred, including its condition and any accessories that are included. They will also need to provide proof of payment of the transfer tax, which is currently $200.

Additional documents that must be attached to the form include a photograph of the applicant, two sets of fingerprints, and a certification from a chief law enforcement officer (CLEO) in the applicant's jurisdiction.

Form 4 is required whenever a firearm regulated under the NFA is transferred between individuals or entities, such as between a private citizen and a licensed dealer. Failure to properly register the firearm and pay the required taxes can result in criminal charges.

Strengths of Form 4 include ensuring that firearms are transferred legally and that taxes are paid. Weaknesses may include the complexity of the form and the time and effort required to properly complete it.

Alternative forms or analogues to Form 4 may include Form 1 (Application to Make and Register a Firearm) or Form 5 (Application for Tax Exempt Transfer and Registration of Firearm). The main difference between these forms is the purpose of the transfer and whether taxes are required.

Submitting Form 4 requires sending the completed form, along with all required documentation, to the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF). The form should be stored securely and only shared with parties who have a legitimate need to see it.

Overall, Form 4 is an important document for ensuring that firearms are transferred legally and that taxes are paid. It is important for applicants to carefully review and complete the form to ensure that the transfer is legal and that all requirements are met.