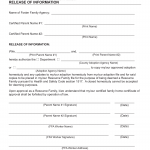

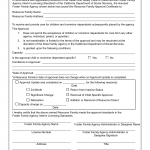

Form LIC 00. Conversion to Resource Family: Release of Information - California

Form LIC 00 is used in California for the conversion to a resource family. It serves as a release of information, authorizing the exchange of relevant information between the applicant and the licensing agency.

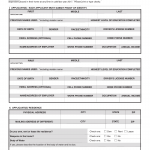

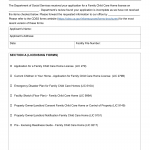

Form LIC 00A. Conversion - Resource Family Application - California

Form LIC 00A is an application form specifically designed for individuals who want to convert their existing foster care license or approval to become a resource family in California.

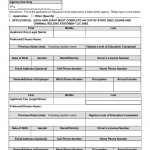

Form LIC 01A. Resource Family Application - California

Form LIC 01A is an application form used in California for individuals interested in becoming a resource family. The purpose of this form is to initiate the application process and gather essential information about the prospective resource family.

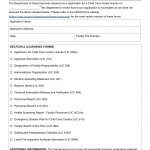

Form LIC 01C. Resource Family Application-Confidential - California

This form, Form LIC 01C, is a confidential resource family application used in California. Its main purpose is to collect personal and sensitive information about the applicant and their household members for the evaluation and approval process.

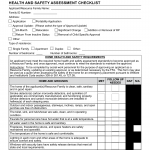

Form LIC 03. Resource Family Home Health And Safety Assessment Checklist Document For Agency Use Only - California

Form LIC 03 is a document for agency use only in California. Its purpose is to provide an assessment checklist for evaluating the health and safety of a resource family home during the approval process.

Form LIC 05A. Resource Family Approval Certificate - California

Form LIC 05A is a resource family approval certificate used in California. Its main purpose is to officially certify the approval of a resource family to provide foster care services.

Form LIC 126. Entrance Checklist - Family Child Care Homes - California

Form LIC 126 is an entrance checklist specifically designed for Family Child Care Homes in California. Its main purpose is to assess and document the compliance of a family child care home with the licensing regulations prior to admission.

Form LIC 165. Board Of Directors Statement - California

Form LIC 165 is a statement form used in California by the Board of Directors of a licensed facility or organization. Its main purpose is to provide a formal statement from the Board of Directors affirming their support and responsibility for the operations and compliance of the facility.

Form LIC 184B. Notification Of Incomplete Application - Family Child Care Home - California

Form LIC 184B is a notification form used in California for incomplete applications specifically related to Family Child Care Homes. Its main purpose is to inform the applicant that their application is missing required information or documentation.

Form LIC 184C. Notification Of Incomplete Application (NOIA) Child Care Centers -В Pre-30-Day NOIA - California

Form LIC 184C is a notification form used in California for incomplete applications related to Child Care Centers. Its main purpose is to notify the applicant of an incomplete application and request the missing information or documentation.