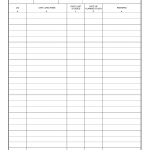

DA Form 1829. Hospital Food Service - Ward Diet Roster

The DA Form 1829 is used by hospital food service personnel to record and track dietary requirements for patients in a ward or medical unit. It serves as a roster that lists each patient's name, room number, prescribed diet, and any specific food restrictions or allergies.

DA Form 1845. Schedule of Manpower Studies/Surveys

The DA Form 1845 is used to schedule and document manpower studies and surveys conducted within the Department of Army. It is used to track and record the allocation and utilization of manpower resources.

DA Form 1854-R. Daily Transfer Summary (LRA)

The DA Form 1854-R is used to document and track daily transfers of personnel within the Department of Army Logistics Readiness Agency (LRA).

DA Form 1857. Statement of Account

The DA Form 1857 is used to provide a statement of account for individuals or organizations within the Department of Army. It is used to document financial transactions, such as payments received or expenses incurred, and to reconcile any discrepancies in account balances.

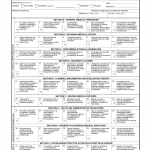

DA Form 1970. House Staff Evaluation Report

The DA Form 1970 is used to evaluate the performance of house staff members in medical facilities. It consists of several parts, including the identification section, which includes the name, rank, and specialty of the staff member being evaluated.

DA Form 1974. Laundry List (Medical Treatment Facility and Organization)

The DA Form 1974 is used in medical treatment facilities and organizations to keep track of laundry items that need cleaning or repair. It consists of a list of items, including clothing, linens, and other fabric-based materials, that require attention.

DA Form 1991. Stock Record Card

The DA Form 1991 is used to keep track of stock levels and transactions for various items in military supply chains. It consists of different sections, including the identification section, stock record section, and transaction record section.

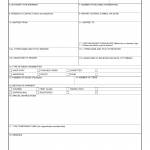

DA Form 1994. Petty Cash Voucher

The DA Form 1994, also known as the Petty Cash Voucher, is used to document and track petty cash transactions within the Department of Army. The form consists of several parts, including the voucher itself, a receipt section, and a summary section.

DA Form 200. Transmittal Record

The DA Form 200, also known as the Transmittal Record, is used to document the transfer of items or documents from one party to another within the Department of Army.

DA Form 2000-3. Installation Inventory Count Card

The DA Form 2000-3, also known as the Installation Inventory Count Card, is used to conduct and document physical inventory counts of equipment and supplies within an Army installation.